View Winners →

View Winners →

Photo by Kelly Sikkema on Unsplash

Californians now have access to a more user-friendly online federal tax return service, the IRS’ free Direct File program. Targeted mainly at those with simple tax returns, such as those with income from a W-2, Social Security, or unemployment benefits, the service became widely available in California, Arizona, Nevada, and other states since its limited launch in January. Unlike other free tax-preparation services that come with income limits and certain restrictions, Direct File offers a direct, step-by-step guide with no middlemen for taxpayers using basic forms.

Direct File only supports a limited range of credits and deductions, making it unsuitable for self-employed individuals, business owners, and those with more complex financial situations. This program is available online only and requires identity verification through ID.me, a service that has faced privacy and security concerns. Although it doesn’t offer tax advice, Direct File provides technical support, and its entries can be saved online to pause and resume later. The service, however, is not yet integrated with California’s CalFile system, so federal information cannot be transferred to state returns seamlessly.

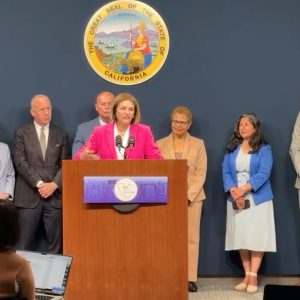

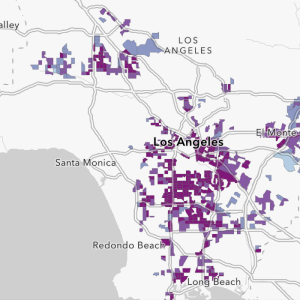

Separately, nonprofit groups like Economic Security California (ESCA) are addressing the issue of unclaimed tax credits in Los Angeles County. Approximately $500 million in tax credits are left unclaimed by residents, and ESCA’s ‘Claim Your Cash’ pilot program aims to connect eligible low-income families with free tax preparers.

Monica Lazo, Southern California program director for ESCA, emphasized that misconceptions often prevent people from claiming their dues, such as fears of losing other benefits or attracting immigration attention. ESCA collaborates with county departments like the Department of Children and Family Services and the Department of Consumer Business Affairs to ensure a ‘warm handoff’ to Volunteer Income Tax Assistance (VITA) tax preparers. The federal and state tax credits available can amount to substantial refunds for qualifying individuals, particularly in low-income families. Lazo noted that the majority of these returned funds contribute to the local economy.

To assist wider communities, ESCA teams up with VITA at multiple locations, including a new center in Whittier, and provides resources through their hotline and website for LA County residents, extending services even to those commuting from outside the county.

As reported by latimes.com and dailybulletin.com.