View Winners →

View Winners →

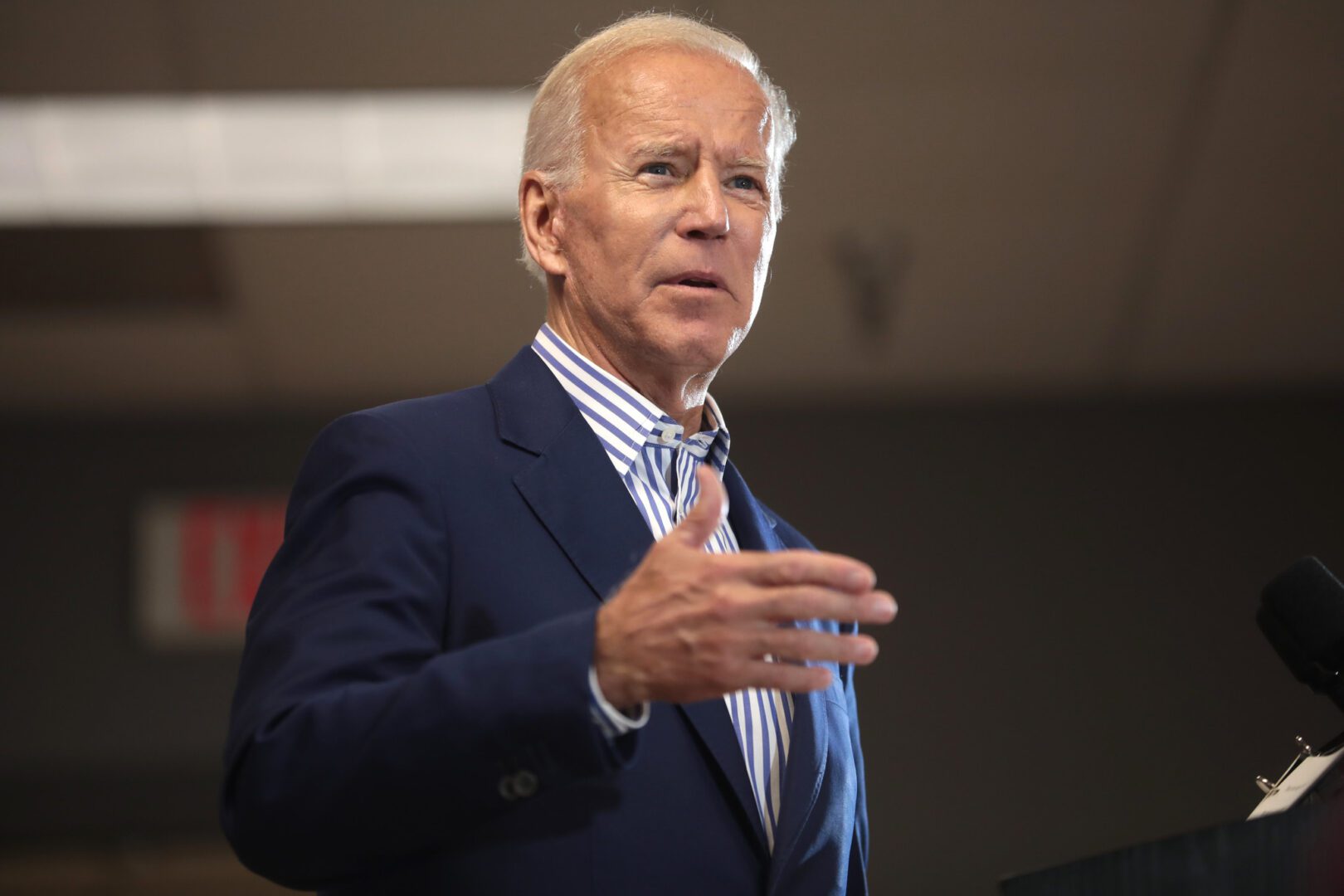

President Joe Biden outlined Monday how his administration is going to address bank collapses over the weekend, and what actions are being taken to build confidence in the banking system.

Signature Bank and Silicon Valley Bank shut down over the weekend. The collapse of Silicon Valley Bank was the second-largest bank failure in U.S. history.

Biden said that he has instructed his team to protect American workers and small businesses in the wake of the bank shutdowns.

“Every American should feel confident their deposits will be there if and when they need them,” Biden said.

“We must reduce the risk of this happening again.”

In his address Monday, Biden said customers’ deposits will be protected and taxpayer dollars will not be used to save the banks. Biden also said those responsible for the bank failures will be held accountable, managers will be fired, and the investors in the banks will not be protected.

Depositors at Signature Bank, which had offices in Beverly Hills, El Segundo, Newport Beach and Ontario, will have access to all of their money starting Monday, one day after it was closed by the New York Department of Financial Services to protect deposits.

The department has appointed the Federal Deposit Insurance Corp. to run the day-to-day operations of the bank. All depositors will be made whole, according to the department.

In a joint statement issued Sunday by Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell and FDIC Chairman Martin J. Gruenberg announcing Yellen’s approval of actions enabling the FDIC to complete its resolution of Santa Clara-based Silicon Valley Bank, also announced “a similar systemic risk exception for Signature Bank,” that fully protects all depositors.

All depositors will have access to all of their money. No losses associated with the closures of Signature Bank and Silicon Valley Bank will be borne by taxpayers, the statement said.

Signature Bank billed itself as “a full-service commercial bank with private client offices throughout the New York Metropolitan area, Connecticut, North Carolina and California” focusing “on serving the financial needs of privately owned businesses, their owners and senior managers.”

Silicon Valley Bank, whose closure was announced Friday, had offices in Santa Monica, Irvine and San Diego.

Biden is flying to San Diego to meet Monday with Australia Prime Minister Anthony Albanese and Prime Minister Rishi Sunak of the United Kingdom to discuss the Australia-United Kingdom-United States Partnership known as AUKUS, the White House said.

Biden will visit Monterey Park on Tuesday to discuss his efforts to reduce gun violence.