View Winners →

View Winners → Jarvis Group, apartment owners seek court invalidation of Measure ULA

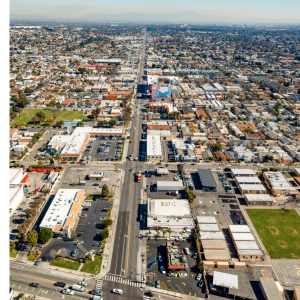

Measure ULA, passed by voters and expected to provide hundreds of millions of dollars annually to build affordable housing and prevent homelessness, violates the state Constitution and City Charter and should be invalidated, the Howard Jarvis Taxpayers Association and the Apartment Association of Greater Los Angeles argue in a new lawsuit.

“If the Measure ULA tax increase is imposed as scheduled on April 1, great and irreparable harm will result to plaintiffs, and to all Los Angeles property owners in being required to pay unconstitutionally imposed taxes,” the Los Angeles Superior Court lawsuit brought Wednesday against the city of Los Angeles states.

A representative for the City Attorney’s Office did not immediately reply to a request for comment. The measure passed with 57% support during the Nov. 8 elections.

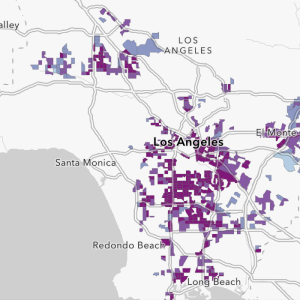

Measure ULA, known as United to House L.A., imposes an additional tax on the sale of any real property on or after April 1, 2023, within the city of Los Angeles when the consideration or value of the real property exceeds $5 million. The tax is referred to in Measure ULA as the “Homelessness and Housing Solutions Tax.”

The additional funds raised by the HHS Tax would go to programs to increase affordable housing in the city.

The plaintiffs maintain Measure ULA is “substantively invalid” because Proposition 13 prohibits special transfer taxes under a section of the state Constitution because Los Angeles Charter permits the city electorate, by initiative, to adopt only an “ordinance which the council itself might adopt.”

Because the Los Angeles City Council is constitutionally forbidden from proposing a transfer tax that is a special tax, and because the city electorate’s initiative power under the City Charter is no greater than the legislative power of the City Council, the electorate is also forbidden from proposing a transfer tax that is a special tax, the lawsuit states.

“Since Measure ULA proposed a special tax, it was beyond the electorate’s power to pass it and is therefore invalid,” according to the suit, which also seeks a declaration of the rights and duties of the parties.