View Winners →

View Winners →

Crude prices have declined more than 15% off their highs from earlier this month. But as usual, and because of market mechanics, that reduction isn’t being felt at the pumps.

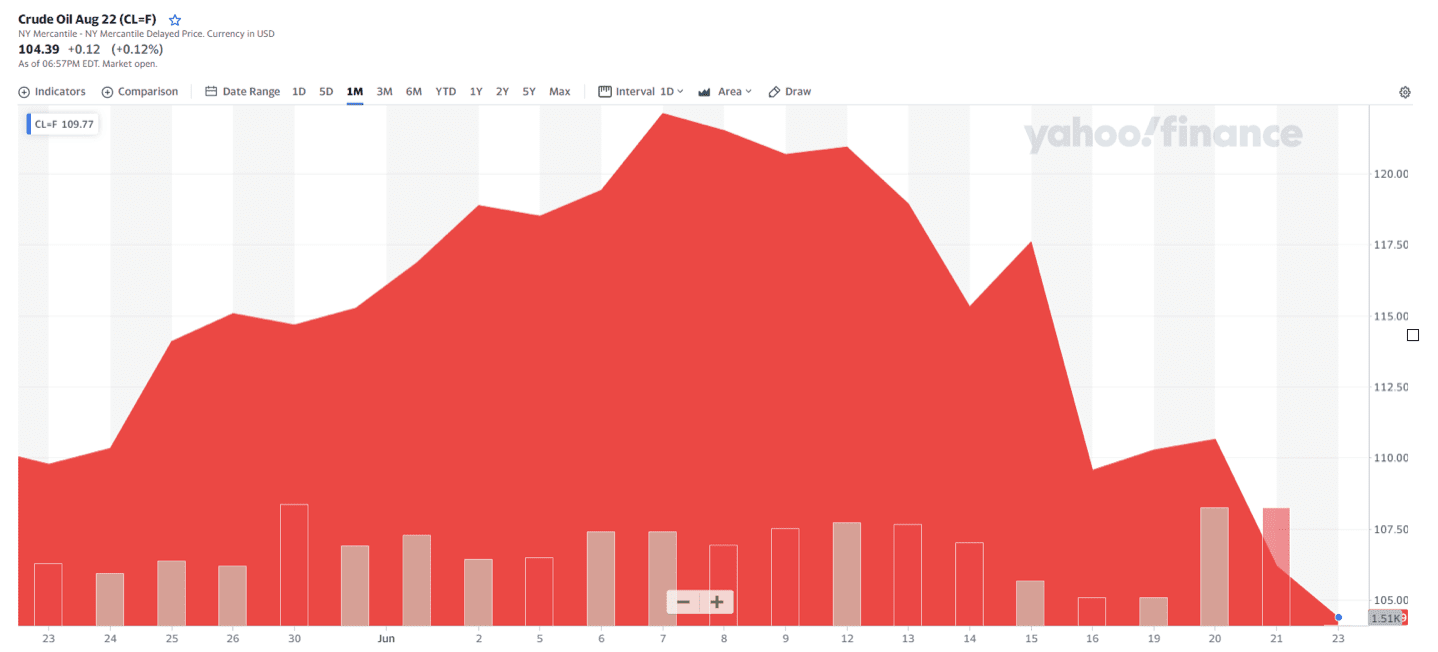

The price for West Texas Intermediate (WTI) oil — the North American oil benchmark — has fallen from its 2022 high of more than $123 a barrel to settle at $104 a barrel.

“If the U.S. and the rest of the world goes into a recession, you can significantly impact demand,” told Houston oil consultant Andrew Lipow Reuters. High gasoline prices could be starting to slow demand, he added.

Crude oil futures for the last month:

The decline in crude oil prices hasn’t translated into an immediate drop in gasoline prices and rarely does. The production chain from drilling to moving oil, refining it and getting it to a gas station is multi-faceted and not correlated immediately with crude oil futures.

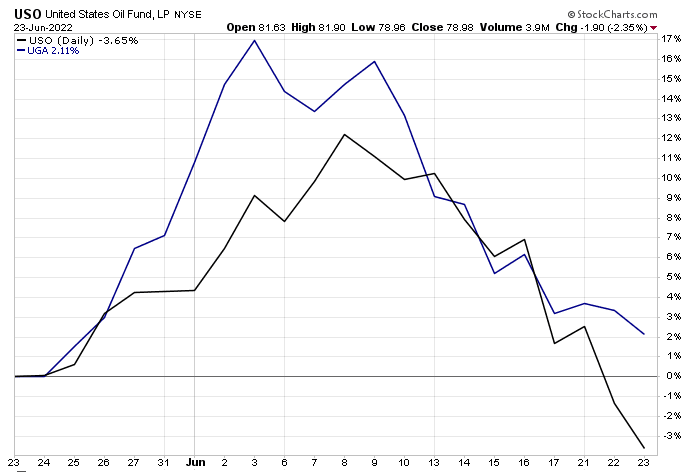

However, using the exchange-traded funds, United States Oil Fund LP (USO), the largest crude oil futures fund, and United States Gasoline Fund LP (UGA), the largest US gasoline futures fund, as proxies for both, we can see that crude oil and gasoline futures are caught up to each other, which should reflect cheaper pump prices in the short term.

Demand is falling as central banks like the Federal Reserve are raising interest rates to tame inflation, which is ironically rooted in energy prices that have soared since Russia invaded the Ukraine, and President Biden’s energy policies have significantly reduced US oil production.

In 2019, the US was the largest oil producer ahead of Saudi Arabia and Russia. But drilling for oil in the US was severely impacted by the Covid pandemic, causing prices to collapse as well as the abovementioned developments.

Energy markets are currently highly volatile, and there’s no reason to think they wouldn’t continue in that manner.

Drew Voros can be reached at drewvoros@heysocal.com.