View Winners →

View Winners →

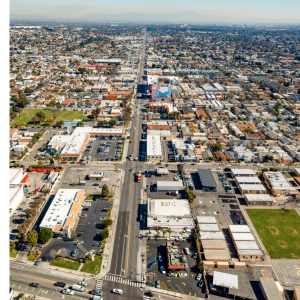

|Photo courtesy of DocFreeman24, Wikimedia Commons (CC BY-SA 4.0)

The owners and managers of one luxury hotel in Santa Monica and two others in Hawaii are suing multiple insurance companies for allegedly breaching contracts to insure them for hundreds of millions of dollars in business losses during the coronavirus.

MSD Capital LP, MSD Real Estate Partners LP and MSD Partners LP brought the complaint Friday in connection with the Fairmont Miramar Hotel & Bungalows in Santa Monica, Four Seasons Resort Hualalai and the Four Seasons Resort Maui at Wailea. The suit names about two dozen insurers as defendants, ranging from ACE American Insurance Co. and Continental Casualty Co. to National Fire & Marine Insurance Co. and Lloyd’s of London. The plaintiffs seeks unspecified damages as well as a judge’s declaration that the plaintiffs’ losses are covered under the policies.

“When the COVID-19 pandemic began to sweep through the world in early 2020, travel and tourism ceased abruptly and the (plaintiffs’) hotel bookings and … business income dropped to zero,” according to the suit, which further states the MSD plaintiffs have suffered hundreds of millions of dollars in damages since March 2020 and expect to suffer millions more with a return to normalcy taking months if not years.

A representative for ACE American Insurance could not be immediately reached.

“Overnight, hotel properties that were once bustling destinations attracting travelers from all over the world became ghost towns,” the suit states.

The MSD plaintiffs’ hotels were forced to shutter their doors for most of 2020, according to the suit.

The MSD plaintiffs have suffered significant property damage losses from the presence of the coronavirus in and around their hotels, including booking cancellations, refunds and rebates that have been given to hotel guests and the lack of customers who would normally visit for dining, bar, sporting and spa services had the properties not been forced to close under government orders in California and Hawaii, the suit states.

In addition, despite taking significant precautions, guests and staff members at the hotels have been infected by the COVID-19, according to the suit.

The MSD plaintiffs purchased hundreds of millions of dollars of property insurance from the defendants to cover the hotels and the coverage includes business interruption for losses resulting from direct physical loss or damage to property, the suit states.

But the insurers so far have refused to pay anything, maintaining that the pandemic does not constitute direct physical loss or damage and that certain provisions within the policies bar coverage for the MSD plaintiffs’ coronavirus-related losses, the suit states.

“These arguments contravene the plain meaning of the coverage language and are inconsistent with case law across the country interpreting the same or similar policy provisions,” the suit states. “Moreover, in stark contrast to other policies in the marketplace, many of the policies do not contain exclusions for communicable disease or viruses, confirming that the presence of a virus, whether on or near insured property, can cause loss or damage to property.”