View Winners →

View Winners → A Calm Port in the Perfect Storm

One Example of the Powerful Senior Reverse Mortgage

One Example of the Powerful Senior Reverse Mortgage

By Steve Aranda

I recently got a phone call from a past client of mine. She asked how I’d been doing. I told her about my kids, about business, about the things that people talk about in polite conversation when they haven’t spoken for some time.

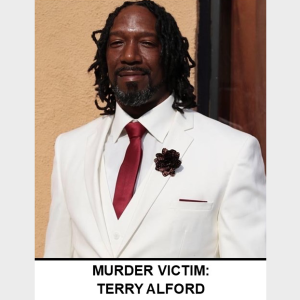

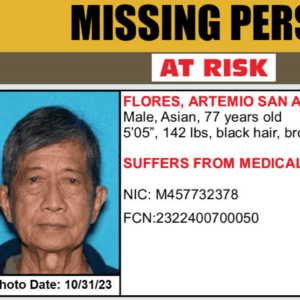

Appropriately, I asked her how she had been. After a moment of silence, she told me that her father had recently suffered an untimely death. She was, in fact calling on behalf of her mother, who didn’t understand finances well, and who was in no condition to handle the kind of conversation that needed to take place.

Her father was in relatively good health when he passed away unexpectedly nearly 4 months ago. He also happened to be the primary source of income in his household. He left behind a devastated widow, a huge hole in the income she had become accustomed to, and specifically, no way to afford the mortgage on their home. At the time of our conversation, my client’s mother was 90 days late on her mortgage, and the bank was beginning the foreclosure process.

After a brief conversation, I discovered two extremely important facts. First, although the widow was in no way able to make the payments on her home, nor to earn enough to support her lifestyle, she was over 62 years of age – 68 in fact.

Second, she had a substantial amount of equity in her home. These two facts made all the difference in the world, because they are the primary factors required to establish eligibility for a senior reverse mortgage.

A senior reverse mortgage is unlike any other loan. The most appealing aspect of this loan is that you don’t have to make payments on it – ever –regardless of how much you borrow, or for what reason. In fact, it’s possible the loan will pay you.

To qualify for a senior reverse mortgage, you need to be at least 62 years of age. You must have enough equity in your home. This is determined by both your age, and your home’s value in relation to the amount you need to borrow.

You must also live in the home as your primary residence. With a senior reverse mortgage there are no employment or income requirements, no restrictions on how the money can be used, and any proceeds you receive are non-taxable.

The widow in our story had twelve more years left to pay on a mortgage of $1600 per month. Not including the mortgage, she had living expenses of about $1200 per month, but her income was only $800.

After setting up her senior reverse mortgage, she had no mortgage payments at all, and a line of credit for $100,000 which she could draw from on a monthly basis in order to supplement, or even replace her income. She didn’t have to make payments on it either.

To learn more about Senior Reverse Mortgages, consult www.aarp.org, www.hud.gov, or write me an email.

Steve Aranda is a mortgage banker specializing in Government Lending and Private Mortgage Banking for Super Jumbo products. Feel free to write him with your questions at steve.aranda@prospectmtg.com