View Winners →

View Winners → 5 Financial Resolutions to Make in The New Year

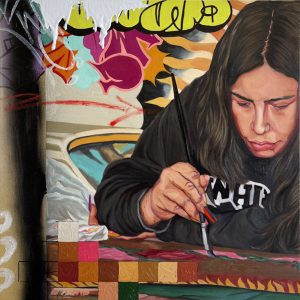

Any time you receive a raise at work, consider adjusting the money you set aside for your retirement accounts. | Courtesy photo by Micheile Henderson on Unsplash

For many of us, the new year means a fresh start and the chance to set new goals. As you consider your resolutions, you may want to add “strengthen my financial foundation” to the list. Here are five ways you can put yourself on firmer financial footing in 2021:

1. Identify what’s working and what isn’t

There may be aspects of your financial life that are meeting your expectations and others that aren’t. Most important is to determine if you are on track to achieve key financial goals. Are you saving enough for retirement or your kids’ college education? Do you have enough in your emergency fund? Are your investments well positioned for the long run? Consider meeting with a financial advisor to get an objective opinion on what’s working and areas of potential improvement.

2. Develop an achievable spending plan

There is a constant tug-of-war between spending money and saving it. If you can find ways to trim your spending, you’ll have more money to set aside toward your most important goals, such as retirement and education funding. It may start by establishing a spending cap for each month.

3. Boost your retirement plan contributions

Any time you receive a raise at work, consider adjusting the money you set aside for your retirement accounts by a comparable percentage. For example, if you invest $200 per paycheck into your workplace retirement plan, and then receive a 3% raise, consider increasing your retirement plan contribution to $206 (equal to 3%). Making that a regular habit can help you achieve your goals more quickly.

4. Make sure you are set for emergencies

A rainy-day fund is foundational to your financial plan. In times when you face an increased risk of an interruption to your income (like in today’s more economically challenged environment), it takes on added importance. You want at least three to six months of expenses covered by your emergency fund. If you are short of that, make a priority of adding to it.

5. Explore your borrowing options

If you are paying a mortgage, car loan, student debt or credit card balances, consider more cost-effective ways to manage your debt. Finding ways to refinance debt at a lower interest rate is one consideration. Another is to focus on paying off the most expensive debt more quickly. Check your credit score to determine how it might impact your financing options. Gaining more control over debt is an important way to improve your financial standing over the next year.

Focus on fundamentals

Good intentions are in ample supply at this time of year. The key to making meaningful changes is to focus on the fundamental aspects of your financial life and follow through on the plans you make. Working with a financial advisor can help you be more accountable and provide guidance to help you stay on track.

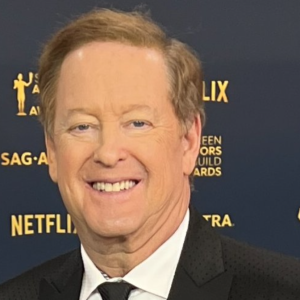

Jean D Koehler, RICP, CRPC, CKA, CLTC is Financial Advisor and Business Financial Advisor with Ameriprise Financial Services, LLC., a financial advisory practice of Ameriprise Financial Services, LLC. In Arcadia, CA. She specializes in fee-based financial planning and asset management strategies and has been in practice for 20 years. To contact her, ameripriseadvisors/jean.d.koehler. Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser. Ameriprise Financial Services, LLC. Member FINRA and SIPC. © 2020 Ameriprise Financial, Inc. All rights reserved.