View Winners →

View Winners → A Look at Governor Newsom’s 2021-22 State Budget Proposal

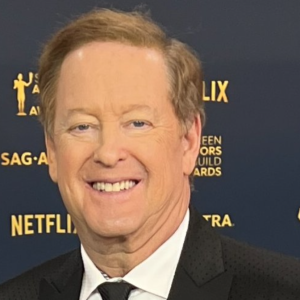

Governor Gavin Newsom presenting the 2021-22 budget on Jan. 8, 2021. | Screenshot courtesy of the Office of Governor Gavin Newsom on YouTube

Governor Gavin Newsom on Friday submitted his 2021-22 State Budget proposal to the Legislature — a $227.2 billion spending plan with a $15 billion surplus.

Last summer, state leaders feared a $54.3 billion shortfall because of a pandemic-induced recession. Estimates, however, could not foresee a surging stock market that bolstered the wealthiest residents of the state.

“We’ve got a lot of work to do to help small and medium-sized businesses, but folks at the top are doing pretty damn well,” Newsom said. “But I don’t begrudge that success, I admire and respect it.”

According to the Associated Press, “Californians made a record $185 billion in capital gains income — money earned from the sale of assets like stocks, land or a business — resulting in $18.5 billion in tax revenue for the state.”

The governor’s budget proposes $372 million to speed up administration of vaccines across all of California’s 58 counties. (Currently, Bloomberg’s vaccine tracker ranks California 42nd nationwide for the percentage of COVID-19 vaccines used.) It also dedicates more than $14 billion to various coronavirus-related relief programs — including direct cash supports of $600 to millions of Californians through the Golden State Stimulus, extending new protections and funding to help keep people in their homes and investing in relief grants for small businesses.

Evictions remain a looming problem as tenant are at risk of losing their homes if they are unable to pay their rent in full in the coming weeks. Cal Matters reports that “Some 2 million Californians could be evicted on Feb. 1 unless the deadline is extended. Newsom said he’s working with legislative leaders on a plan and wouldn’t divulge details until they’re closer to agreement.”

The governor has also proposed approximated $90 billion total to fund schools. The commitment includes investments to target the inequitable impacts of the pandemic on schools and families, including $2 billion to support and accelerate safe returns to in-person instruction, $4.6 billion to help students bounce back from the impacts of the pandemic and $400 million for school-based mental health services.

As Politico summarized it, “Newsom proposed Friday using much of California’s bounty from the rich to help those who have suffered disproportionately, as well as students who are failing in record numbers as they try to navigate a remote learning environment.”

The budget also proposes $777.5 million for a California Jobs Initiative, which focuses on job creation and retention, regional development, small businesses and climate innovation.

The budget reflects $34 billion in budget resiliency — budgetary reserves and discretionary surplus — including: $15.6 billion in the Proposition 2 Budget Stabilization Account (Rainy Day Fund) for fiscal emergencies; $3 billion in the Public School System Stabilization Account; an estimated $2.9 billion in the state’s operating reserve; and $450 million in the Safety Net Reserve. The state is operating with a $15 billion surplus.

The budget continues progress in paying down the state’s retirement liabilities and reflects $3 billion in additional payments required by Proposition 2 in 2021-22 and nearly $6.5 billion over the next three years. In addition, the improved revenue picture allows the state to delay $2 billion in scheduled program suspensions for one year.

Additional details on the 2021-22 State Budget is below.

Immediate Actions to Provide Relief and Safely Reopen Schools

- $2.4 billion for the Golden State Stimulus – a $600 state payment to low-income workers who were eligible to receive the Earned Income Tax Credit in 2019, as well as 2020 Individual Taxpayer Identification Number (ITIN) filers.

- $575 million to more than double this year’s funding for grants to small businesses and small non-profit cultural institutions.

- $70 million to provide immediate and targeted fee relief for small businesses including personal services and restaurants.

- $2 billion targeted specifically to support and accelerate safe returns to in-person instruction starting in February, with priority for returning the youngest children (transitional kindergarten through second grade) and those with the greatest needs first.

Initial $372 Million Set Aside for COVID-19 Vaccinations

The budget sets aside an initial $372 million in state funds, which can be allocated immediately as needed, for expenses to expedite the delivery of COVID-19 vaccinations.

Accelerating Economic Recovery and Job Creation

The budget also proposes $4.5 billion for the Equitable Recovery for California’s Businesses and Jobs plan, including:

- $1.5 billion for the infrastructure and incentives to implement the state’s zero-emission vehicle goals.

- $1.1 billion immediate relief for small businesses.

- $777.5 million for a California Jobs Initiative to provide incentives targeted at accelerating investment and job creation.

- $353 million for workforce development.

- $300 million for deferred maintenance and greening of state infrastructure.

The budget also invests $385 million for targeted investments to build a more sustainable agricultural industry.

K-14 Education

The budget reflects the state’s highest-ever funding level for K-14 schools — approximately $90 billion total, with $85.8 billion under Proposition 98.

Targeted investments in special education include $545 million in ongoing funds and $300 million in ongoing funds for early intervention for infants, toddlers and preschoolers. The budget also proposes over $475 million to ensure teachers and classified staff have the opportunities, funding and preparation they need as professionals.

The governor is also proposing $2 billion for immediate action to accelerate returns to in-person instruction beginning in February, based on a phased-in approach that starts with the youngest students. To help students that need additional support outside the classroom, $4.6 billion is proposed for action this spring to expand learning opportunities, including summer and after-school programs. To address the mental health needs of students, especially as a consequence of trauma and the pandemic, $400 million is proposed for school-based mental health. All of these funds will prioritize students and communities disproportionately impacted by the pandemic, with funds strongly weighted toward schools serving students from low-income families, foster youth, homeless students, English learners and others disproportionately impacted by the pandemic.

Early Education and Child Care

The budget includes $250 million in incentive funds for districts that expand transitional kindergarten programs. The budget also includes $200 million one-time General Fund for transitional kindergarten and kindergarten facilities and $50 million one-time Proposition 98 General Fund for professional development focused on preparing teachers for early childhood programs. The budget includes $545 million ongoing funding and adding $300 million for additional special education for infants, toddlers and preschoolers this year.

Higher Education and Workforce

The budget proposes a General Fund increase of $786 million for the University of California and the California State University with an expectation that they focus on measurable goals to address equity gaps, further maintain online educational opportunities and expand dual admissions and other innovative strategies that reduce time to degree completion. The budget also assumes resident tuition and fees remain flat in 2021-22.

The budget proposes an overall $353 million investment in workforce development. It includes a $250 million one-time General Fund to support workforce development and better linkages between higher education and gainful employment. The budget also proposes early action for $25 million to immediately expand existing High Road Training Partnership Program apprenticeship programs, and additional funding for the California Apprenticeship Initiative work-based learning opportunities through the community colleges.

The budget proposes early action on a portion of these incentives in the spring to accelerate recovery before the 2021-22 fiscal year begins in July.

Addressing Health Care Affordability and Aging

The budget proposes to implement the California Advancing and Innovating Medi-Cal (CalAIM) initiative to “reduce variation and complexity in the state’s Medi-Cal program, manage member risk and need and improve outcomes through payment reform,” according to a statement from the governor’s office. The effort will reportedly include housing-related services and flexible wraparound services so health plans may avoid costlier alternatives to hospitalization, skilled nursing facility admission and/or discharge delay.

Housing and Homelessness

In addition to the $500 million for infill infrastructure, the budget also proposes an additional $500 million in low-income housing tax credits.

Through Homekey the state has awarded $846 million to 51 local agencies to secure over 6,000 units of permanent housing for individuals and families who had been homeless. The budget includes $1.75 billion one-time General Fund to purchase additional motels, develop short-term community mental health facilities and purchase or preserve housing dedicated to seniors. The budget also proposes changes to the state’s Medi-Cal system to support behavioral health and housing services that can help prevent homelessness.

Emergency Response and Preparedness

The Budget adds $143 million General Fund to support 30 new fire crews, and also includes $48 million to continue phasing in Black Hawk helicopters and large air tankers.

Additionally, the budget proposes $17.3 million for earthquake early warning.

Climate Change Action

The budget proposes an additional $1 billion to support a coordinated forest health and fire prevention strategy that maximizes technology and science-based approaches to protect state forestlands, including $39 million for LiDAR remote sensing and research. The budget proposes $323 million for early action in the spring to start these forest health and fire prevention projects before the next fire season.

The budget proposes a $1.5 billion comprehensive strategy to achieve the state’s zero-emission vehicle goals by 2035 and 2045, including securitizing up to $1 billion to accelerate the pace and scale of the infrastructure needed to support zero-emission vehicles.

Environmental Justice

The budget includes $300 million one-time General Fund for toxic site cleanup and investigations of high-priority contaminated properties in impacted communities across the state, which will be prioritized based on public health risk criteria.

Results-Oriented Government and Digital Transformation

The COVID-19 pandemic has required many businesses to be flexible, creative and innovative. As the employer of a workforce of over 250,000, the state also responded immediately by putting in place a statewide telework program and new ways to conduct state business. This shift has meant the state must also evaluate its portfolio of state leases to determine spaces that can be released and/or consolidated.

The budget assumes a 5% permanent reduction in state operations expenditures, challenging departments and agencies to find more efficient means to provide services to Californians.

For further information on these and other items in the Governor’s Budget, the full Governor’s Budget Summary is available at ebudget.ca.gov.