View Winners →

View Winners → Dear Emmy, Do I Need a Power of Attorney Even Though I Have a Will?

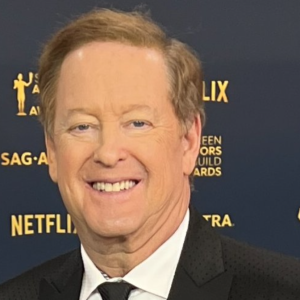

Although many professionals and business representatives may be involved in your estate planning, powers of attorney are legal documents, and should be prepared by a qualified lawyer. – Courtesy photo

A will and power of attorney (POA) serve different purposes. Drafting one does not relive the need for the other. Powers of attorney, either for healthcare or finance, are in effect while you are alive. In contrast, a will only takes effect after death to provide instructions for the distribution of your assets.

A durable power of attorney for healthcare, or a “healthcare directive,” allows you to appoint an attorney-in-fact to make healthcare decisions for you when you can no longer make them for yourself. In an advance healthcare directive, you may state your wishes regarding life-sustaining treatment, organ donation, and funeral arrangements. A directive also allows a pre-authorized agent to access your medical information. This could be especially important in light of strengthened federal privacy laws.

A durable power of attorney for finance or property management decisions would also be helpful if you ever become incapacitated. They address any assets that are not held within a living trust. (A living trust, unlike a will, can take effect before death). POAs give detailed instruction of how your assets are to be managed during any incapacitation, both temporary (for example, a scheduled surgery) or permanent (dementia perhaps). A will cannot address these situations.

It is a good idea to empower a trusted person to act on your behalf with respect to financial matters, such as signing tax returns or dealing with retirement benefits.

Although many professionals and business representatives may be involved in your estate planning, powers of attorney are legal documents, and should be prepared by a qualified lawyer.

Securities and Advisory Services offered through National Planning Corp. (NPC), member FINRA/SIPC, a Registered Investment Advisor. EH Financial Group, Inc. and NPC are separate and unrelated companies.