View Winners →

View Winners → Energy-efficient home improvements that can lower taxes in 2025

In 2021, Americans collectively paid $2.2 trillion in income taxes, according to the most recent data from the Tax Foundation. On average, individuals paid $14,279. Needless to say, the days leading up to April 15 can be expensive.

As this year’s tax season wraps up, people may be looking for ways to save when they file in 2025. One popular way to do that is through a tax credit, which offers taxpayers the opportunity to directly deduct from their tax liability, or the amount of taxes they owe.

Homeowners looking to earn a tax credit through home improvements when they file next year should consider energy-efficiency. With tax credits rewarding clean energy initiatives and energy-efficient home improvements, homeowners could annually subtract thousands of dollars from their taxable income.

Who can take advantage? According to a Rocket Loans study conducted in 2023, about 42.7% of homeowners anticipated doing some kind of home improvement that will help increase their property’s energy-efficiency. For those homeowners — and anyone else planning to make their home greener — tax savings could be in their future.

How much energy-efficiency can save the average homeowner

While the upfront cost of many eligible home improvements may be high, there are a few different ways homeowners can get some of that money back.

Rocket Loans calculated the average amount a homeowner could pay for such improvements and the tax credit they could receive based on that estimated cost. Along with tax savings, they could also save on utility costs by using less energy.

The government lists eligible improvements under one of two credits: the Energy Efficient Home Improvement Tax Credit and the Residential Clean Energy Tax Credit.

Energy Efficient Home Improvement Tax Credit

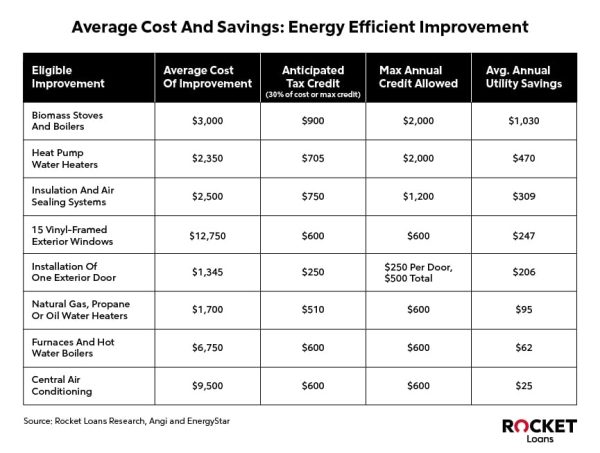

The Energy Efficient Home Improvement Credit allows homeowners to claim 30% of qualified expenses up to $3,200, each year they make improvements. That means homeowners can claim credit for multiple improvements up to a total of $3,200. Under that umbrella amount, specific home improvements have a max amount people are allowed to claim annually.

Based on the average cost of each improvement listed, the table above shows the tax credit a homeowner could receive, the maximum amount they can claim and how much they could save in utilities.

Residential Clean Energy Tax Credit

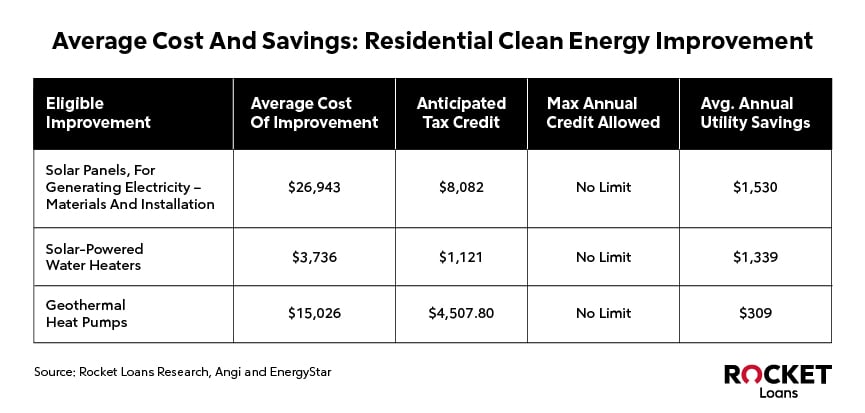

The Residential Clean Energy Tax Credit is equal to 30% of the costs of any new improvement that changes how a home receives power using clean energy. These must be qualified improvements and may include the following: solar panels, wind turbines, geothermal heat pumps, fuel cells and battery storage technology.

Other than fuel cell property, there is no limit for these credits — both annually and lifetime until the credit begins to phase out in 2033.

Based on the average cost of each clean energy improvement listed, the table above shows the tax credit a homeowner may receive, how much they could save in utilities and how much it may increase their home value.

If the homeowner is leasing solar panels, they do not qualify for the tax credit.

The average costs of each improvement for the energy-efficient and clean energy home improvements listed were sourced from the most recent data from Angi as of March 2024. The average annual utility savings are based on the $2,060 average annual amount a U.S. family spends on home utilities, according to EnergyStar. This number was used as the base number from which we multiplied the average percent of savings for each energy improvement.

Other money-saving incentives for energy-efficient updates

Along with federal tax credits, there are also state and local subsidies, incentives and rebate programs available for homeowners who wish to make their homes more energy-efficient. Homeowners should speak with their local and state energy offices and/or program administrators to learn more about what’s available in their area.

Those who receive any financial incentive on their project may need to subtract the money saved from the total cost of any improvement project they’re claiming. The amount after the financial incentive is deducted is what should be reported for the tax credit. For more information, speak to a tax attorney.

Financing energy-efficient home improvements

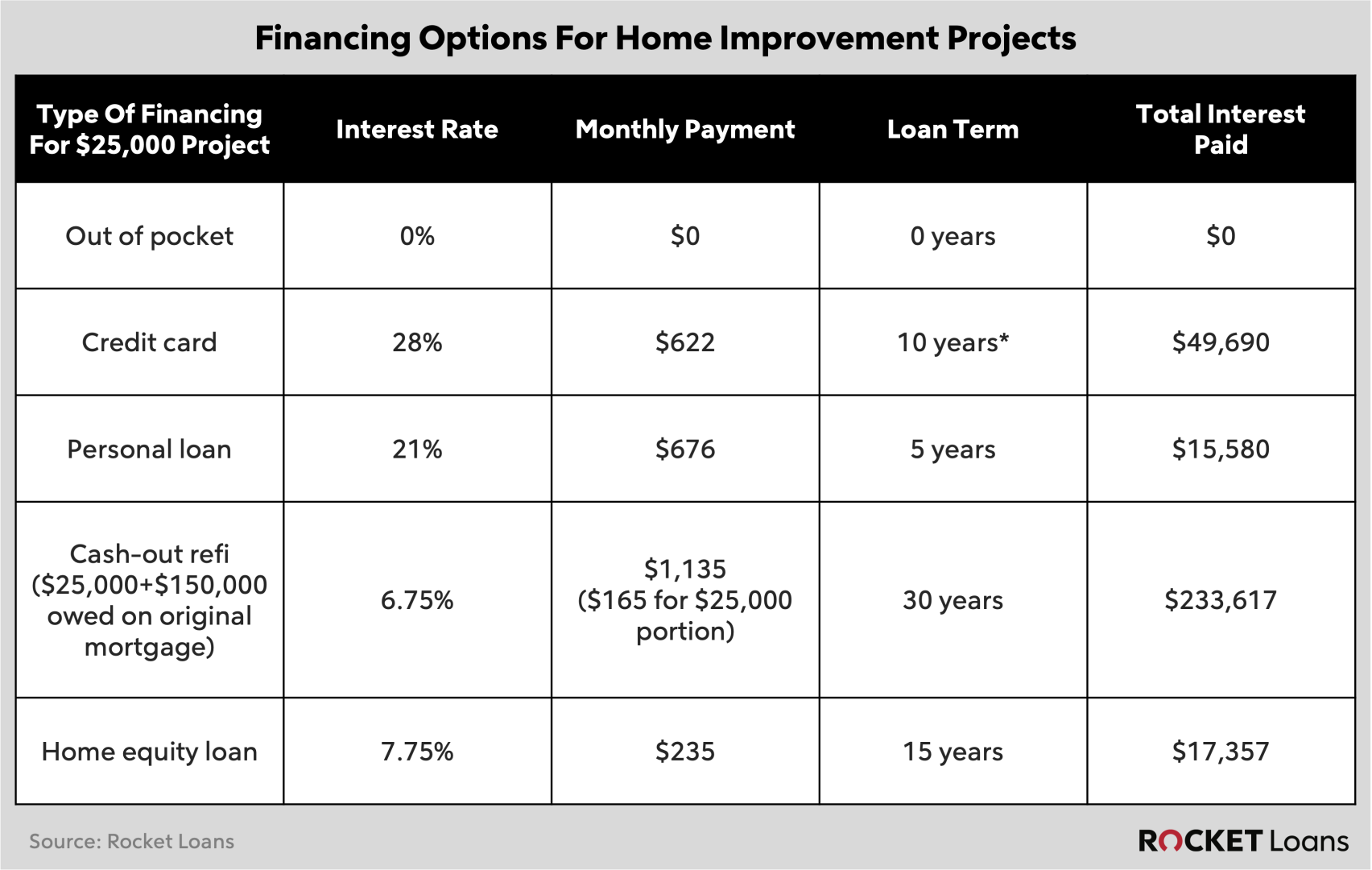

Energy-efficient updates to the home can be expensive — some costing tens of thousands of dollars. Luckily for homeowners, there are a few different ways to finance such projects. The right option will depend on the homeowner’s financial situation and goals.

While a breakdown of each financing option can help with understanding how much one may expect to pay each month and in total, keep in mind, the numbers will be different depending on the project, timeline, location and financial situation.

Several ways to finance home improvements

The example above uses estimated average interest rates as of March 20, and is for a home improvement project costing $25,000. This will be the amount financed for each scenario. The loan amount, interest rate and loan term were plugged into the Rocket Loans Simple Loan Calculator to get the monthly payment and total interest paid, rounded to the nearest dollar.

Since the cash-out refinance would roll the current mortgage in, the total amount borrowed would be the original balance owed, plus the $25,000 borrowed for the project. It’s important to keep in mind, too, that a home equity loan is a second mortgage. Because of this, the monthly payment, interest, term and total interest paid will all be in addition to what is paid on the primary mortgage.

Closing costs are not included. While credit cards are revolving debt, with no set term, this example uses a borrower’s goal of paying the loan off in 10 years.

Summary: Improvements can be expensive, but there are ways to save

Energy-efficient improvement costs run the gamut from a few hundred to tens of thousands of dollars. But there are ways to save on costs, finance the project and financially benefit from these improvements. One benefit may be saving money on taxes with the Energy Efficient Home Improvement Tax Credit and the Residential Clean Energy Tax Credit.

Written by Lauren Nowacki. This story was produced by Rocket Loans and reviewed and distributed by Stacker Media. The article was retitled and copy edited from its original version.

Re-published with CC BY-NC 4.0 License.