View Winners →

View Winners →

The Internal Revenue Service Monday further extended the tax deadline for most California taxpayers to Nov. 16.

In the wake of last winter’s storms, the normal spring due dates had previously been postponed to Monday, Oct. 16.

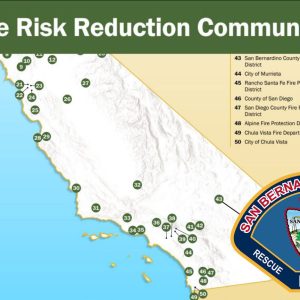

With the new extension, most individuals and businesses in California will now have until Nov. 16 to file their 2022 returns and pay any tax due. Fifty-five of California’s 58 counties — all except Lassen, Modoc and Shasta counties — qualify.

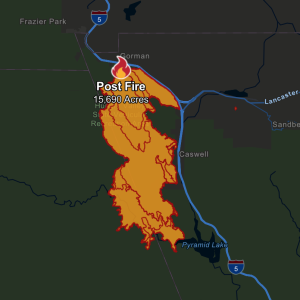

IRS relief is based on three different Federal Emergency Management Agency disaster declarations covering severe winter storms, flooding, landslides, and mudslides over a period of several months. As long as a resident’s or business’ address of record is in a disaster-area locality, taxpayers automatically get the extra time, without having to ask for it.

Eligible returns and payments qualifying for the new deadline include:

- 2022 individual income tax returns and payments normally due on April 18;

- For eligible taxpayers, 2022 contributions to IRAs and health savings accounts;

- Quarterly estimated tax payments normally due on April 18, June 15 and Sept. 15;

- Calendar-year 2022 partnership and S corporation returns normally due on March 15;

- Calendar-year 2022 corporate and fiduciary income tax returns and payments normally due on April 18;

- Quarterly payroll and excise tax returns normally due on May 1, July 31 and Oct. 31; and

- Calendar-year 2022 returns filed by tax-exempt organizations normally due on May 15.

Other returns, payments and time-sensitive tax-related actions also qualify for the extra time.