An Agoura Hills-based real estate developer has agreed to plead guilty to federal bankruptcy and tax fraud charges, according to court papers filed Monday.

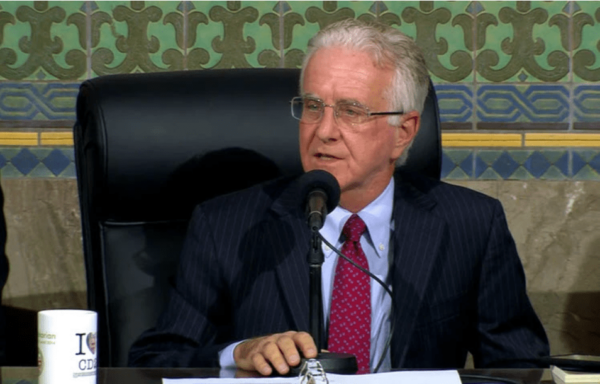

Mark Handel, 68, will enter his plea on a date to be determined to making a false statement in bankruptcy and submitting a false tax return, according to the U.S. Attorney’s Office.

Handel has agreed to forfeit about $3.54 million, which represents the proceeds of the sale of real estate in Alameda County. He also has agreed to pay to the Internal Revenue Service roughly $1.45 million in tax liabilities, which include civil fraud penalties, documents filed in Los Angeles federal court show.

According to his plea agreement, in April 2015, Handel filed a bankruptcy petition in Los Angeles in which he knowingly made false statements. Under penalty of perjury, Handel stated that he had no income from 2013 until April 2015. In fact, Handel earned about $2.26 million in income from DTMM Construction Inc., his West Los Angeles-based real estate development company.

Handel caused DTMM, which, according to court documents, stands for “Don’t Touch My Money,” to be registered in his wife’s name but used DTMM to deposit the profits from his own work as a real estate developer and to pay for his and his family’s living expenses.

Handel concealed his income from his creditors by depositing it into DTMM’s accounts, prosecutors said.

Among the assets Handel hid from creditors was his interest in real estate in Livermore, his plea agreement states.

In October 2016, Handel signed and filed a false federal income tax return for the tax year 2015 that failed to disclose almost $1.1 million in additional income. Handel further admitted that for the tax years 2010 to 2017, he failed to report a total of about $6.88 million of income on his federal tax returns.

Handel also falsely reported a net operating loss of $7.25 million on his 2017 federal income tax return as well as underreported his income on his 2018 tax return by $1.41 million and admitted to failing to pay $460,408 in additional tax.

Once Handel pleads guilty to both charges, he will face a sentence of up to eight years in federal prison, prosecutors noted.