Six in 10 millennials who don’t own a home say it’s because of student loan debt, according to a 2021 survey from the National Association of Realtors.

College costs skyrocketed in the last two decades. Average tuition between 2010-11 and 2020-21 school years rose nearly 31% at public universities and more than 41% at private universities, according to the Education Data Initiative. Students now pay an average of $35,551 a year.

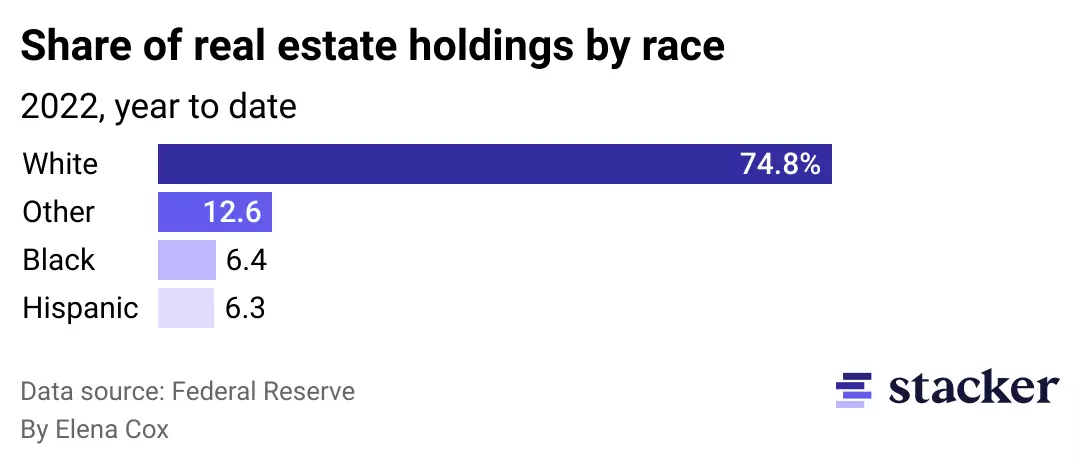

This debt has worsened the racial homeownership gap, which has widened over decades of discriminatory lending practices, racist housing policies, and barriers to wealth for Black Americans and other people of color. These trends led higher numbers of students from marginalized communities to assume additional financial risk for a college degree.

For many, loans make college possible. More than 45 million people in 2020 had student loan debt, averaging $37,693 per person, per Education Data Initiative. These costs have made it difficult for many to afford a down payment on a home. The homeownership rate falls by nearly 2 percentage points for every additional $1,000 in student loan debt a borrower holds, according to the Federal Reserve.

Stacker examined data from the Federal Reserve and the Department of Education to see how federal student loan forgiveness could boost U.S. homeownership rates, particularly among Black Americans.

Because Black Americans have historically been unable to build wealth as easily as their non-Black counterparts, they’re relying more on loans to obtain big-ticket items like higher education and homeownership. Higher student loan payments and interest rates hinder their ability to buy a home and can trap them in a cycle of inequality. In August 2022, the Biden administration announced it would forgive $10,000 in student loan debt, affecting about 43 million borrowers.

Keep reading to see the effect of student loan forgiveness on Black homeownership rates in the U.S.

You may also like: 30 college majors that didn’t exist 50 years ago

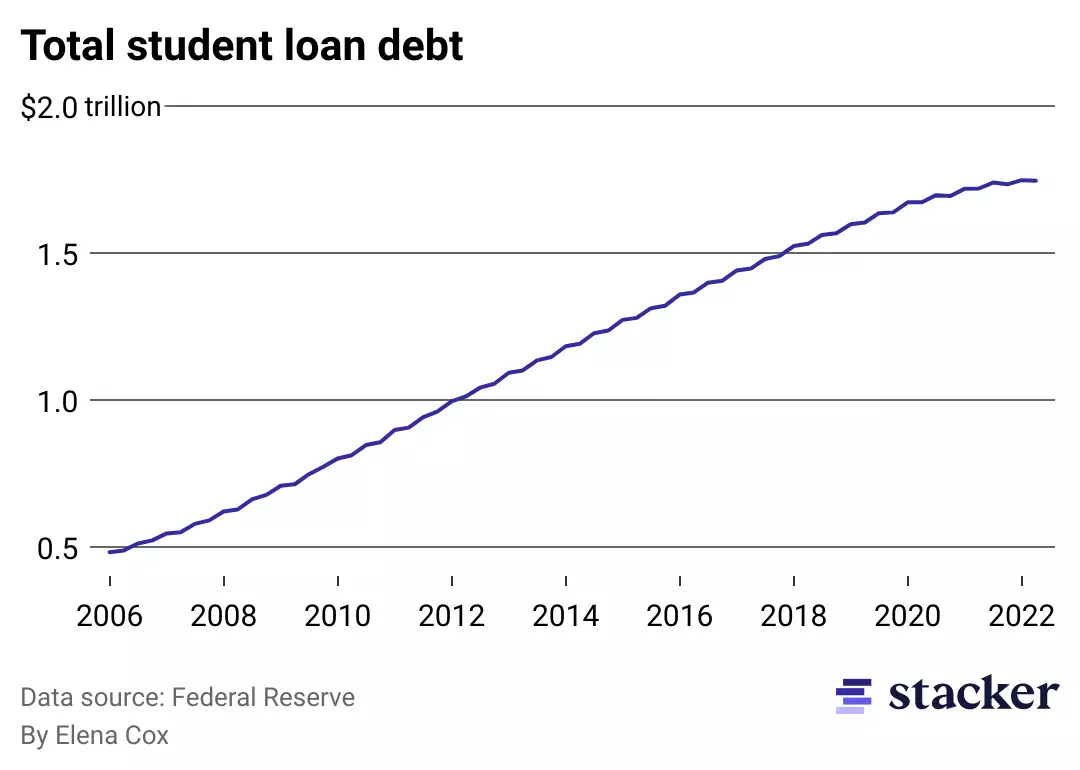

Americans hold more than $1.7 trillion in student loan debt

Student loan debt has nearly tripled since 2006.

Although total debt continues to increase, the growth rate decelerated considerably. In 2013, the year-over-year change was 12.1%; last year, it was 0.31%.

The federal government paused federal student loan payments during the pandemic, which set interest rates at 0% and allowed borrowers to skip loan payments without the risk of late fees or default. This policy helped 4.7 million people lower their balances, but it’s due to expire at the end of 2022.

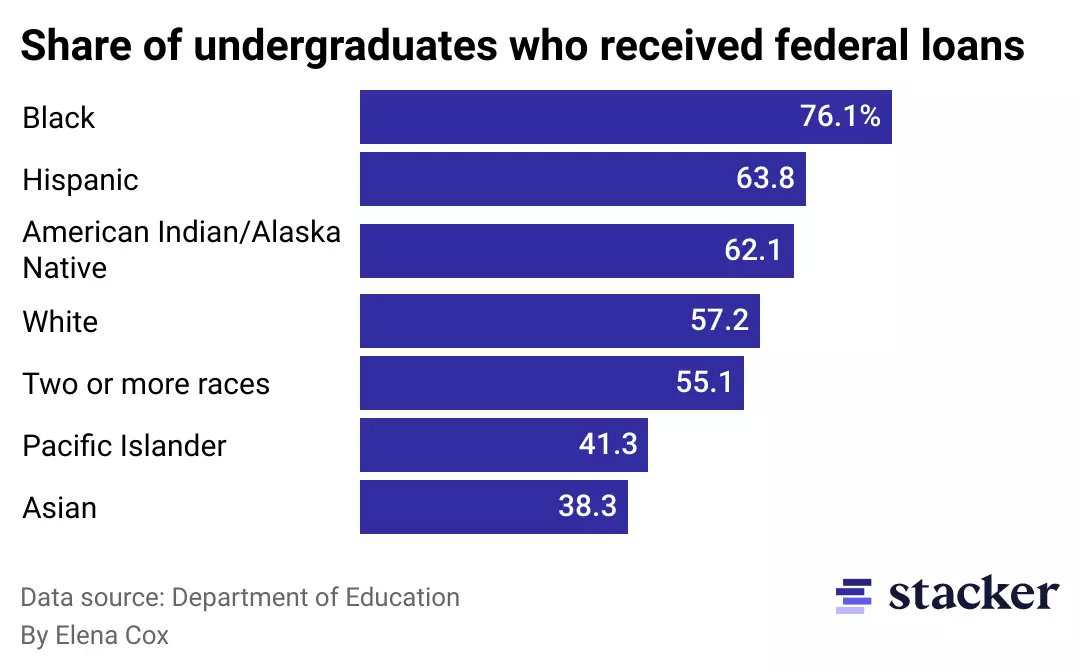

Black and Hispanic students are more likely to have student loan debt

A Brookings Institute analysis found that Black Americans face a cycle of inequality when paying for higher education. The report found that Black American households cannot build wealth at the same rate as non-Black households. This finding also means Black students borrow more money for college and have higher loan payments upon graduation, which reduces their opportunities to build wealth during their prime earning years.

Hispanic Americans also experience a wealth gap, which fuels the need to take out more in student loans, according to UnidosUS. Many Hispanic Americans are also first-generation college students, which can make it difficult for them to navigate the financial aid system.

Black Americans have lower homeownership rates

The Black homeownership rate (43.4%) lags considerably behind white Americans (72.1%) and has declined by nearly 1 percentage point since 2010, according to the National Association of Realtors. In fact, that gap is wider today than when the Fair Housing Act was passed in 1968.

Black households also lag in earnings, making only 61 cents for every dollar that comparable white households earn, according to an analysis by the Economic Policy Institute of the latest Census Bureau data. With lower earnings on average, Black Americans are denied mortgages at double the national average, according to a 2022 LendingTree study.

Black Americans will often seek higher education to help increase their earning potential. Still, it’s hard to take on more debt when student loan debt payments make up a significant portion of a monthly budget. Due to student loan debt, nearly half of Black Americans said they would likely delay homeownership.

What student loan forgiveness could mean for Black Americans

Black Americans face disparities in wealth building, and student loans have exacerbated that issue. More than half of Black American households with student loan debt have no or negative net worth, about twice as much as those with no student debt, according to a Brookings Institute analysis.

Student loan forgiveness would not eliminate the racial wealth gap but could significantly reduce it. Loan forgiveness may also present more opportunities for Black Americans to afford homes and build intergenerational wealth consistent with the American Dream.

Written by: Jill Jaracz

Re-published with CC BY-NC 4.0 License.