View Winners →

View Winners → Smart Women, Smart Money (9/8/16 Issue)

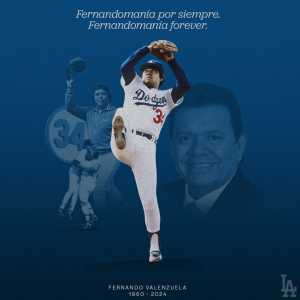

– Courtesy photo.

Dear Emmy: Would You Write a Column About Why Women Need Long-Term Care Insurance? I’d Like My Mother to Read That.

Gladly. Long-term care insurance is an incredibly important part of a person’s overall retirement plan – especially for women. Females, on average, live longer, have higher rates of disability and have fewer financial resources than men. Women are more likely than men to run out money in later life.* Lucky us.

Women are commonly the primary caregiver for their spouse. Yet, women who need care themselves are less likely to have a family caregiver. About 70 percent of women over the age of 75 are widowed or otherwise unmarried. Nearly half over 75 live alone.

A third of long-term care insurance claims begin between ages 70 and 79 and over half begin after 80. Couple this with the fact that two-thirds of Americans over 85 are women. With a longer life expectancy and a greater likelihood of needing long-term care, elderly women often confront their health needs without the help of their spouse or other family members.

Compared to men, women spend twice as many years in a disabled state at the end of their lives. So, most insurance companies charge women more than men for equal coverage. It’s essential that a comprehensive health plan is put in place well before the need arises – and this doesn’t apply just to women.

There are basically four ways to pay for long-term care: out of your own pocket, with long-term care insurance, using Medicaid or Medicare. Medicare’s benefits are limited. For those that have too much to qualify for Medicaid, but not enough to pay out of pocket, which is the majority of women – and men – insurance is a vital bridge.

Start by comparing the benefits and costs of different policies. Ask these questions: Does the policy protect against inflation? Does it provide for both in-home and nursing home care? Is the policy’s renewal guaranteed and how long is the maximum benefit period?

Search for the best deal, but also be realistic. Your mom must choose a policy she can afford. Ensure that the policy’s premium fits comfortably within her budget.

If you plan to buy a policy, do so sooner rather than later. Not only can premiums grow exorbitant if one waits until their late 60s or 70s, coverage might be denied altogether. Married people often qualify for a couple’s discount. Look into this. Employed people should speak to their human resources department to see if their employer can access a discounted rate.

Long-term care is truly a woman’s issue. Despite that, long-term care is something few women adequately plan for. Don’t make that mistake.

* Long-Term Care – Important Information for Women

** Women & Long-Term Care

Past performance is not indicative of future returns Opinions voiced are for general purposes only, aren’t intended to provide specific advice or recommendations for any individual and don’t constitute an endorsement by NPC. Securities and Advisory Services offered through National Planning Corp. (NPC), member FINRA/SIPC, a Registered Investment Advisor. EH Financial Group, Inc. and NPC are separate and unrelated companies.