By Chris Horymski

With all the challenges facing millennials and Generation Z, retirement savings may not even rank among the top concerns for under-40 workers, according to a recent Experian survey.

As finding an affordable place to live, covering vehicle expenses, and paying down student loans mostly take priority, many younger workers may have been discouraged from saving for retirement before they even began. Older generations haven’t generally fared well at saving for their retirements either, which also may have discouraged younger workers.

Experian asked 1,020 millennial and Generation Z workers about saving for retirement as well as some hypothetical questions about how they might adjust their budget to contribute more to their retirement. Our survey was conducted August 11 to 13, 2023 and was collected using a third-party company, not Experian’s consumer credit database

Experian

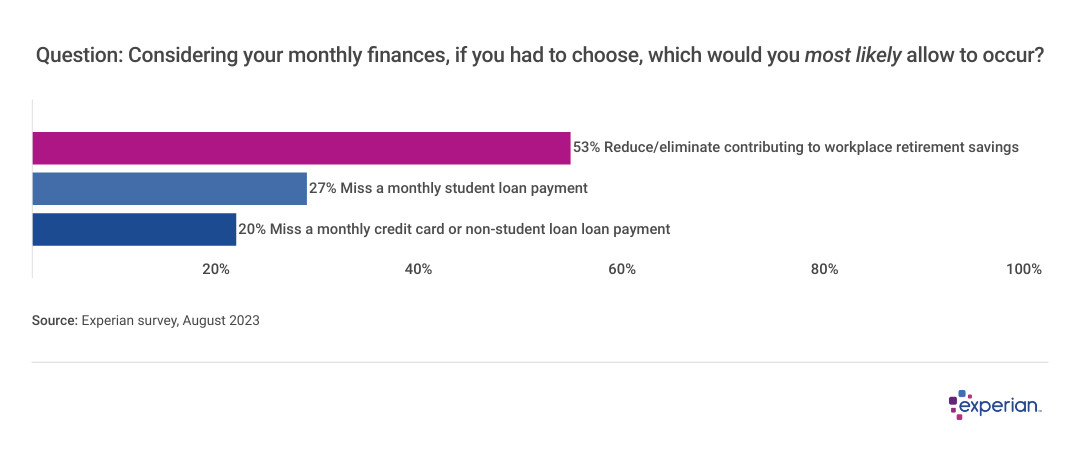

Most say they would cut retirement savings first

We asked millennials and Gen Zers with student loans which expense they would choose to skip a payment on, if push came to shove. Most (53%) would reduce or eliminate contributing to their retirement savings plan before missing either a credit card payment or student loan payment.

None of these choices are a bargain, however. Missing a credit card payment means late fees, a potential APR hike, and a potential hit to one’s credit score if the payment is 30 or more days late.

Although workers with student loans probably aren’t relishing repayments that begin again in October, they quite likely prefer to see either the principal decrease or notch another month of payments toward the 120 months needed for some types of forgiveness programs, like the Public Service Forgiveness (PSLF) program.

But suspending workplace retirement savings plan contributions has its own downsides, some financial and others attributable to the human condition. Just like getting back to the gym, restarting contributions may feel more difficult once you’ve stopped, even for a short period.

Perhaps the worst reason to suspend retirement savings contributions is thinking you’ll have plenty of time to catch up. Assuming even a conservative nominal return of 5% annually on retirement savings, every $1,000 saved earns an additional $3,300 after 30 years, either tax-deferred or tax-free, depending on the type of retirement account. Waiting just five years to “catch up” reduces that gain to $2,300.

Experian

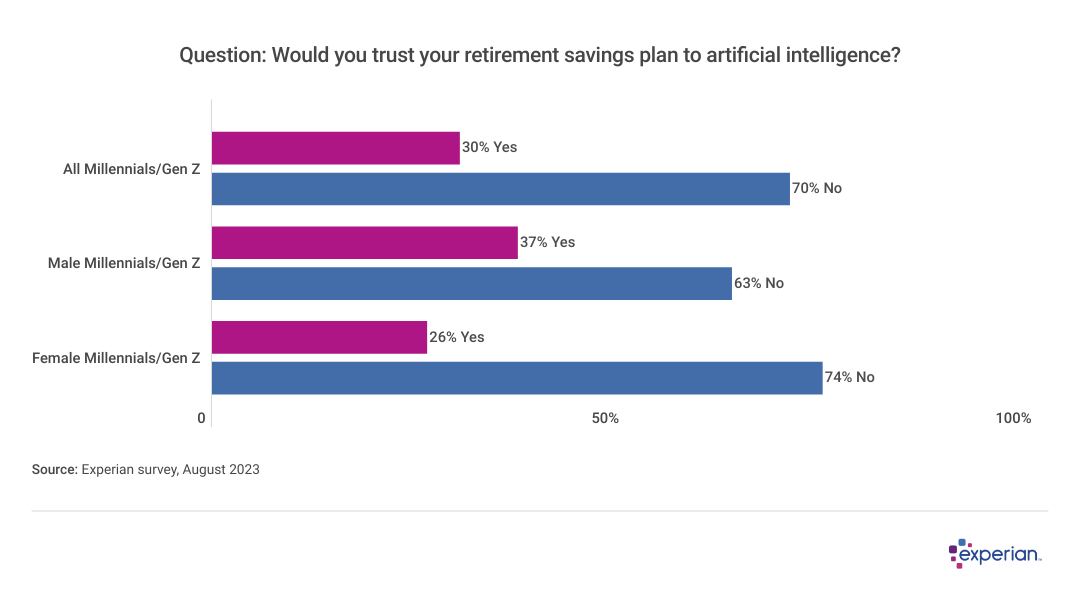

Artificial intelligence by any other name

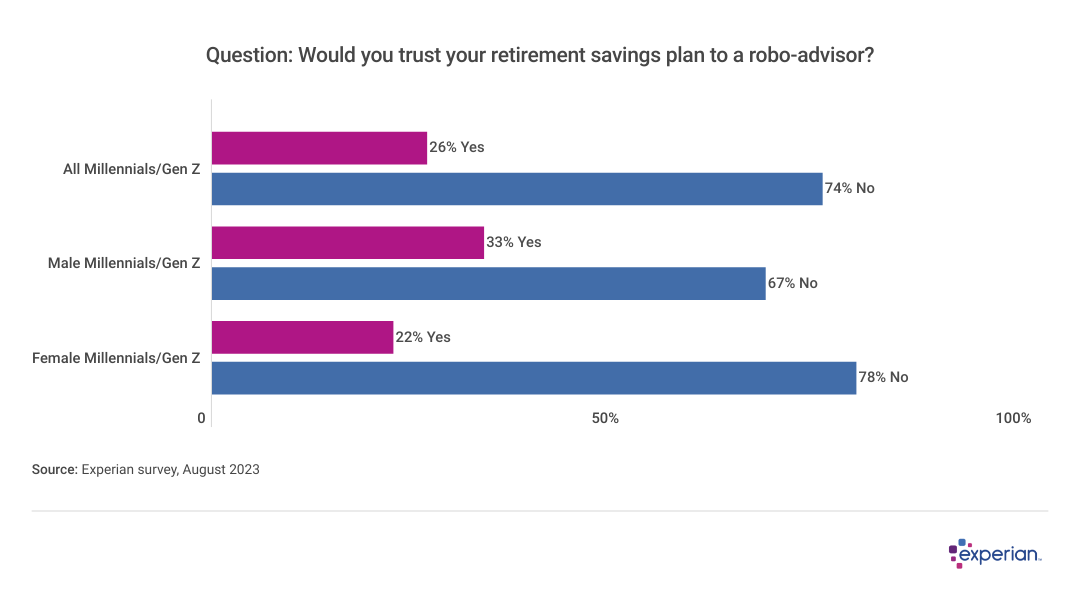

We asked millennials and Gen Zers who have retirement savings if they would trust their retirement savings to either a robo-advisor or artificial intelligence—partly because it’s unclear to many what or if there’s a distinction to be made between the two. Plot twist: It may not matter; most don’t trust either option.

Experian

Robo-advisors are seen as even less attractive option than AI

Drilling down a bit, age didn’t really matter: Both Gen Z and millennials look askance at either robo-advisors or AI managing their retirement nest eggs. However, men appear slightly more likely to trust the computer with their retirement savings, either through already established retirement savings plans directed by so-called robo-advisors, or the still-searching-for-a-definition AI-informed retirement savings.

Despite the answers, there are many well-designed retirement plans that already employ qualities of robo-advisors and AI. For instance, target-date funds, available in most 401(k) and similar workplace savings plans, pre-allocate retirement investments based on one’s expected retirement year. In general, asset allocation is heavily tilted toward stocks for younger savers such as millennials and Gen Zers. Later on in their career, investors will see those same funds shift more toward income-generating investments, while still including a healthy percentage of stocks.

Experian

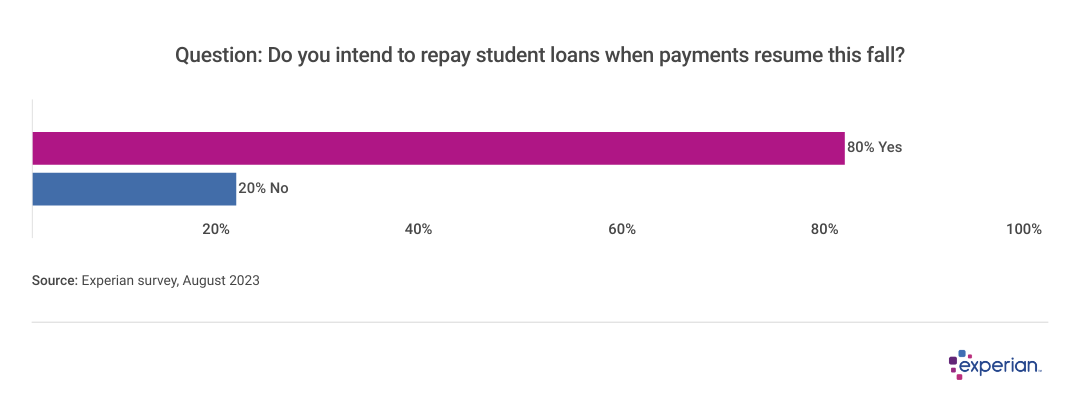

Most expect to pay their student loan payments resuming this fall

When student loan repayments resume, most millennials and Gen Zers with student loans said they expect to begin repaying their loans.

Fortunately, there may be remedies that make either answer easier to swallow. Those answering in the affirmative, for example, may be benefiting from income-driven repayment plans, which have received further enhancements over the years so that borrowers won’t pay more than a small percentage of their discretionary income.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.

Re-published with CC BY-NC 4.0 License.