By Cezary Podkul

This story was originally published by ProPublica. ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

Imagine if each time your wages were deposited in your bank account, your employer deducted a fee of 1.5% to 5% to provide the money electronically. That, increasingly, is what health insurers are imposing on doctors. Many insurers, after whittling down physicians’ reimbursements, now take an additional cut if the doctor prefers — as almost all do — to receive funds electronically rather than via a paper check.

Such fees have become routine in American health care in recent years, according to an investigation by ProPublica published on Monday, and some medical clinics say they’ll seek to pass those costs on to patients. Almost 60% of medical practices said they were compelled to pay fees for electronic payment at least some of the time, according to a 2021 survey. With more than $2 trillion a year of medical claims paid electronically, these fees likely add up to billions of dollars that could be spent on care but instead are going to insurers and middlemen.

Congress had intended the opposite to happen. When lawmakers passed the Affordable Care Act in 2010, they encouraged the use of electronic payments in health care. Direct deposits are faster and easier to process than checks, requiring less labor for doctors and insurers alike. “The idea was to lower costs,” said Robert Tennant of the Workgroup for Electronic Data Interchange, an industry group that advises the federal government.

When the Centers for Medicare & Medicaid Services created rules for electronic payments in 2012, the agency predicted that shifting from paper to electronic billing would save $3 billion to $4.5 billion over 10 years.

That’s not how it played out. CMS quickly began hearing complaints from doctors about fees. An industry of middlemen had begun sprouting up, processing payments for insurers and skimming fees off the top. Sometimes they shared a portion of the fees with insurers, too. The middlemen companies say they offer value in return for their fees and insist that it’s easy to opt out of their services, but doctors say otherwise.

CMS responded to the complaints in August 2017 by publishing a notice on its website reminding the health care industry that electronic payments were not a profit-making opportunity. The agency cited a long-standing rule that prohibited charging fees. (Technically, the government banned “fees or costs in excess of the fees or costs for normal telecommunications,” such as the cost of sending an email.) The rule had been on the books since 2000, but the insurers and their middlemen weren’t abiding by it.

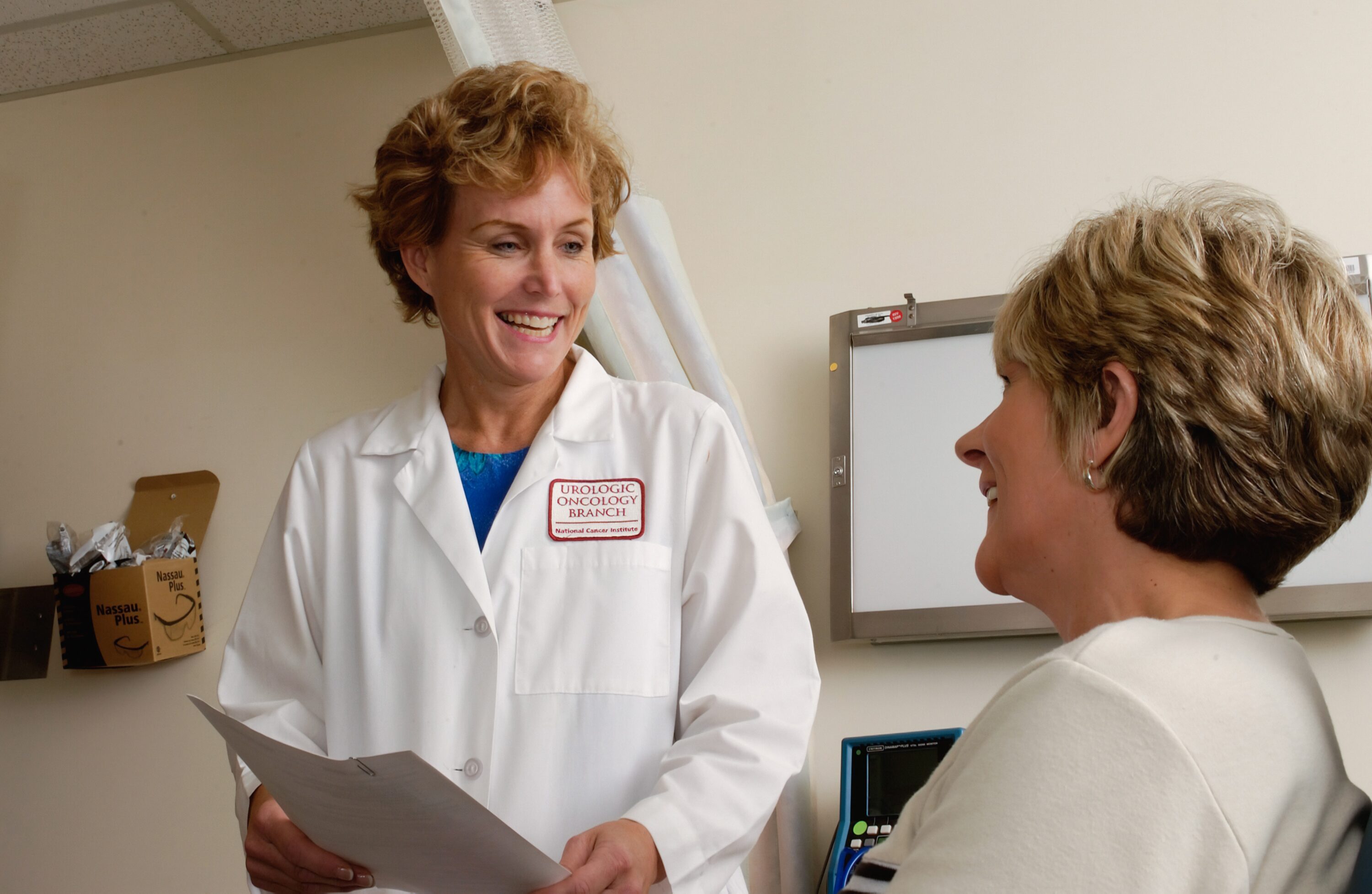

Within six months of that pronouncement, however, CMS suddenly removed the fee notice from its website. The decision baffled doctors such as Alex Shteynshlyuger, a New York urologist who has made it his mission to battle the fees. Shteynshlyuger began filing voluminous public records requests with CMS to obtain documents showing why the agency reversed course. The records that he eventually obtained, which he shared with ProPublica, provided a rare nearly day-by-day glimpse of how one industry lobbyist got CMS to back down.

The lobbyist, Matthew Albright, used to work at the CMS division that implemented the electronic payment rule. In fact, he was its chief author. He had since moved on to Zelis, a company that handles electronic payments for over 700 insurers and other “payers.” Internal CMS emails show that Albright protested the notice prohibiting fees and demanded that CMS revise the document. Over the ensuing months, as ProPublica outlined, Albright used an artful combination of cajoling, argument and legal threat. He claimed the rule against fees applied only to direct transactions between insurers and doctors, but electronic payments involved middlemen such as Zelis, so the prohibition didn’t apply. CMS ultimately dropped its ban on fees.

The move benefited Zelis and other payment processors. The losers were doctors, who say they’re often not given an option to get paid electronically without agreeing to a fee. In March, for example, when Shteynshlyuger called Zelis to enroll in electronic payments from one insurer, a Zelis rep quoted him a fee of 2.5% for each payment. When he complained, the call got transferred to another rep who said, “The lowest we can go is 2.1%.”

Zelis said in a statement that it “removes many of the obstacles that keep providers from efficiently initiating, receiving, and benefitting from electronic payments. We believe in provider choice and actively support their ability to move between payment methods based upon differing needs and preferences.” Zelis did not respond to detailed questions about Albright’s interactions with CMS or make him available to discuss that topic. CMS said that it “receives feedback from a wide range of stakeholders on an ongoing basis” to understand “where guidance and clarification of existing policy may be needed.”

As for Shteynshlyuger, he’s still on a quest to help doctors avoid electronic payment fees. Meanwhile, his inability to persuade the insurance middlemen often leads him to a step that is the antithesis of efficiency: Whenever he’s asked to pay a fee for an electronic payment, he requests a paper check instead.

Read the full story of the rise of electronic payment fees in ProPublica’s investigation.

ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox. Republished with Creative Commons License (CC BY-NC-ND 3.0).