Lower home prices and slightly lower interest rates improved the outlook for both Los Angeles County and L.A. city homebuyers in the first quarter of 2023, as the state’s housing affordability rose to the highest level in a year, the California Association of Realtors announced Tuesday.

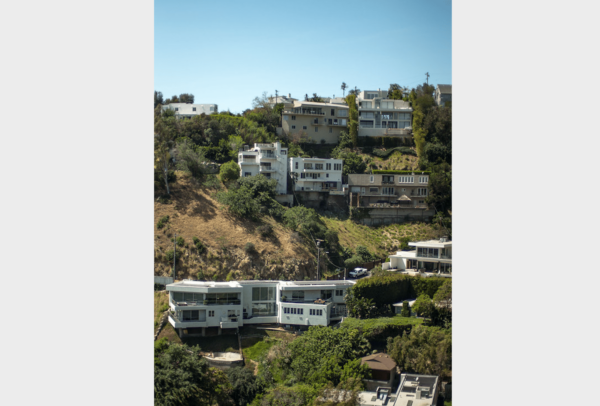

Seventeen percent of L.A. County households could afford to buy the $746,750 median-priced home in the first quarter of the year, up from 13% in the last quarter of 2022, but down from 20% in first-quarter 2022, according to the association.

A minimum annual income of $185,200 was needed to make monthly payments of $4,630, including principal, interest and taxes on a 30-year fixed- rate mortgage at a 6.48% interest rate, the report said.

In the L.A. metro area, 19% of households could afford to buy the $720,000 median-priced home in the first quarter of 2023, up from 18% in the fourth quarter of 2022 but down from 24% in the first quarter of last year. A minimum qualifying income of $178,400 was needed to make monthly payments of $4,460.

In Orange County — considered by CAR one of the least-affordable counties in California — 12% of households could afford to buy the $1.19 million median-priced home in the first quarter of the year, down from 13% in the last quarter of 2022, the same percentage as the first-quarter 2022, according to the association.

A minimum annual income of $296,400 was needed to make monthly payments of $7,410, including principal, interest and taxes on a 30-year fixed- rate mortgage at a 6.48% interest rate, the report said.

Twenty percent of California households could afford to purchase the $760,260 median-priced home in the first quarter of 2023, up from 17% in fourth- quarter 2022 but down from 24% in first-quarter 2022, according to the association.

A minimum annual income of $188,400 was needed to make monthly payments of $4,710, including principal, interest and taxes on a 30-year fixed- rate mortgage at a 6.48% interest rate, the report said.

Meanwhile, 26% percent of home buyers were able to purchase the $619,900 median-priced condo or town home. A minimum annual income of $153,600 was required to make a monthly payment of $3,840, CAR determined.

Looking ahead, while home prices in general are expected to improve in the second half of the year, the statewide median home price is projected to decrease 5.6% to $776,600 in 2023, down from the annual median price of $822,300 recorded in 2022.

The updated projection on the statewide median price, however, is an increase from the estimate of $758,600 forecast last October. CAR also projects the 30-year fixed mortgage interest rate to average 6.3% for the year.

Compared with California, four in 10 of the nation’s households could afford to purchase a $371,200 median-priced home, which required a minimum annual income of $92,000 to make monthly payments of $2,300. Nationwide affordability was down from 47% a year ago.