Those of us who are serious about planning for our financial lives tend to focus most of our attention on strategies to reach our key, long-term goals such as retirement or a child’s higher education. We may not put much strategic thought into how we set money aside to meet more immediate needs. While short-term goals don’t usually carry as big of price tags, reaching them can require the same principles of planning that are essential with achieving long-term goals.

What are short-term goals?

As the name implies, short-term goals have to do with more immediate financial objectives, needs and opportunities. It can be as simple as setting aside enough money each month to pay down certain debts. For example, most people realize that holding credit card debt is very expensive because of the significant related financing costs. Paying off that debt might be an important short-term goal. So is building up an emergency fund to cover unanticipated expenses like a major car or home repair.

You may also set aside money for a down payment on a car or house that you’d like to purchase in the next six months to two years. This, too, is a short-term goal that can benefit from a savings strategy.

Setting your priorities

Short-term goals may not require the significant dollars or the time commitment required for a long-term objective like retirement. Yet it’s still important to determine how these goals fit into your overall budget and savings priorities.

For many people, having an emergency fund with three-to-six months’ worth of income in place is important. This provides a financial cushion should you suddenly lose a job or suffer an injury or illness that makes it impossible to work. If you work independently or own your own business, consider building an even larger financial safety net.

Paying down debts is another important priority. Whether it’s a car loan, student loan or credit card debt, interest charges may be costing you money each month. A starting point is to make sure you stay current with payments. Finding ways to set aside extra money to pay off these debts more quickly can prove to be beneficial to your long-term financial well-being.

Short-term vs. long-term: it’s not an either/or

How will you budget for goals like these with all of the other demands on your finances? Your long-term goals, like retirement or building an education fund, should remain top priorities – but it’s not an all-or-nothing proposition. With thoughtful planning, you can continue to make progress toward your long-term goals while also meeting shorter-term priorities.

Talk to your financial advisor about how to incorporate short-term goals into your comprehensive financial plan.

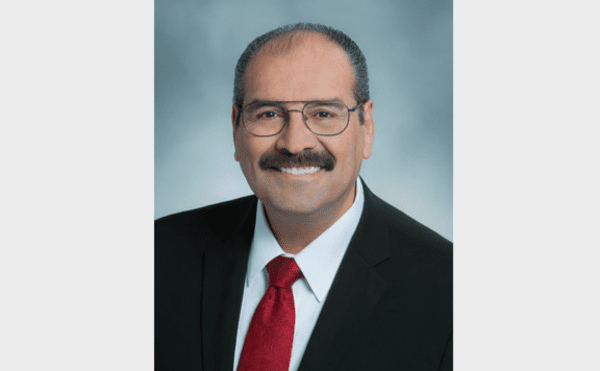

Jean D. Koehler, CLTC®, CRPC®, RICP®, CKA®, is a Financial Advisor with Ameriprise Financial Services, LLC. in Arcadia, Ca. She specializes in fee-based financial planning and asset management strategies and has been in practice for 22 years. To contact her, please visit her website at https://www.ameripriseadvisors.com/jean.d.koehler/ or call her office at (626)254-0455. 55 East Huntington Drive Suite 340, Arcadia California 91006.

Ameriprise Financial and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

This information is being provided only as a general source of information and is not intended to be used as a primary basis for investment decisions, nor should it be construed as advice designed to meet the particular needs of an individual investor.

Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial Services, LLC. Member FINRA and SIPC. © 2022 Ameriprise Financial, Inc. All rights reserved.