View Winners →

View Winners →

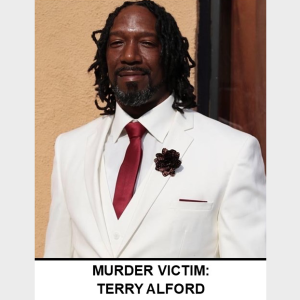

Photo courtesy of Jean D. Koehler

If the start of 2023 has you inspired to take on a healthier approach to your finances, you may be wondering how to do so and where to get started.

Should you focus on reining in your spending habits? Earning more? Investing wisely? All of the above? Here are some practical suggestions to help you improve your financial outlook this year and in the years ahead.

Envision your future. Financial goal setting involves brainstorming. Take the time to consider what you want your financial future to look like and what it will take to get you there. Your goals will flow from the life you want to create for yourself.

Get specific. It’s difficult to act on goals that are too broad or vague. You need to know dollar amounts. For example, if you hope to replace an older car, zero in on the price tag of your next vehicle. Or if you want to purchase a first (or second) home, identify how much you need for a down payment and what monthly payments you can afford. With these specifics in hand, you can calculate how much you need to save each month to achieve a given goal.

Prioritize. Choose a manageable number of goals to work toward. Better to start small and build on your successes. You can sort goals into lists of short-term attainable goals, five-year goals, and long-term stretch goals. The sequence of goal attainment often falls into place naturally. For example, common sense suggests building up your emergency fund and paying down high-interest debt before contributing to a college education fund.

Attach timelines. Goal setting is meaningless without milestones and target dates. Set timelines that are reasonable and achievable.

Document your goals. You’ll want a visual reminder of your goals to make them part of your routine. Create a spreadsheet, put pen to paper or – ideally – work with a financial advisor who can help you map out your goals and document your progress against them. Set a reminder on your phone to review your goals on a daily, weekly or monthly basis. Doing so will keep you focused on accountable for achieving them.

Pair goals with your budget. Realistic financial goals live within a budget. Ideally, your budget will provide guidelines and guardrails for earning, spending, and saving—the key to successful financial goal setting.

Retrain your brain. Goal setting may seem like deprivation if you view it only as cutting back on spending. Reframe your thinking to overcome mental obstacles. See the rewards of putting your time and energy toward actions that move your financial life forward. You might give yourself a psychological boost by doing something nice for yourself during or after goal setting activities. Over time, your mind will connect the two activities so that you find pleasure in both.

Be flexible. Goals are not static. If something changes in your circumstances, you can adjust your goals. If you need to reduce your investment budget while you pay for a much-needed home repair, that’s life. Don’t let a setback derail you. Simply adjust and move on.

Prepare for success. When you make the effort to set attainable financial goals, you’re halfway there. Once you start tackling each of your financial goals, you’ll be inspired to do more. Feelings of financial uncertainty will fade as you take your future into your own hands.

Get expert guidance. An experienced financial advisor can help you with financial goal setting. When it comes to applying strategies to save and invest for your future, their advice is priceless.

###

Jean D. Koehler, CLTC®, CRPC®, RICP®, CKA®, is a Financial Advisor with Ameriprise Financial Services, LLC. in Arcadia, Ca. She specializes in fee-based financial planning and asset management strategies and has been in practice for 22 years. To contact her, please visit her website at https://www.ameripriseadvisors.com/jean.d.koehler/ or call her office at (626)254-0455. 55 East Huntington Drive Suite 340, Arcadia California 91006.

Ameriprise Financial and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Ameriprise Financial Services, LLC. Member FINRA and SIPC. © 2022 Ameriprise Financial, Inc. All rights reserved.