View Winners →

View Winners →

Mounting global fears of a worldwide recession received new confirmation Tuesday as the International Monetary Fund warned that high inflation and the Russian-Ukraine war could send the global economy to the brink of a recession.

In an update to its World Economic Outlook, the IMF also slashed global GDP growth forecasts for this year to 3.2%, as GDP already contracted in Q2. The new estimate is down from its forecast of 3.6% made in April, according to oilprice.com.

Oil prices reacted to the forecast with a selloff, although prices bounced back later in the day. Prices have retreated from a high of more than $120 a barrel only one month ago to less than $95 as of Wednesday, nearly a 20% drop.

Gas prices have reacted similarly, falling nationally and locally.

Falling Prices

The average price of a gallon of self-serve regular gasoline in Los Angeles County decreased today for the 43rd consecutive day since rising to a record, dropping 2.5 cents to $5.728, its lowest amount

since March 9. The average price has dropped 73.4 cents over the past 43 days according to figures from the AAA and the Oil Price Information Service.

California has seen a consistent decline at the pumps for drivers, with the state average now hitting $5.57 a gallon, according to the U.S. Energy Information Administration. That’s almost a 60-cent-per-gallon decline from highs. One year ago, the average was at around $4.10 a gallon.

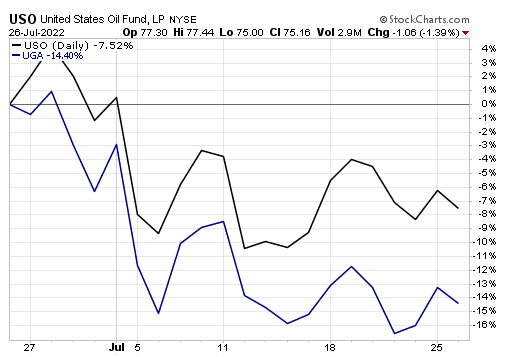

The chart below reflects the largest oil exchange-traded product, the United States Oil Fund (USO), as well as the largest gasoline fund, UGA, which both purchase futures contracts for the respective energy, oil and gasoline. Falling prices are reflected here over the last month.

Oil & Gas Prices Falling

Trend Is Look Downward

With the summer driving season coming to a close, posing mask mandates in Los Angeles County and possibly other regions and a global realization that inflation is pushing economies closer to recession will weigh on gas prices.

On Thursday, the country’s reading on gross domestic product will be released and the consensus is that will not be a glowing report, but one showing a second quarter of contraction. More evidence that inflationary pressures are pushing the economy into a recession.

According to MarketWatch, rarely has GDP shrunk for two straight quarters without a recession being declared, but the organization responsible for making that call takes into account other factors as well, such as the health of the labor market.

What Is A Recession?

High prices for essentials and other economic problems are helping to keep President Joe Biden’s approval ratings low — and providing talking points for the GOP to use against Biden and his fellow Democrats.

On Tuesday, Republicans on the House Ways and Means Committee said in a news release that the Biden administration is “now redefining recession and downplaying the red flags in the economy,” saying it’s a “rebrand” and the “latest attempt to deny the cruel economy they’ve created,” MarketWatch reported.

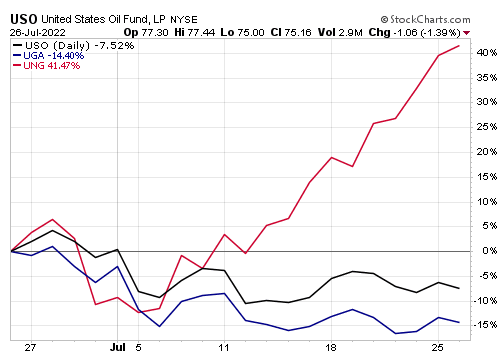

While oil and gasoline prices may be declining, natural gas prices are flowing on an opposite path. Prices have been soaring and as we are going into the fall and winter heating seasons, and with Russia squeezing Europe with cutoff threats and reduced exports, the overall natural gas market is under stress.

Below natural gas prices can be seen at their torrid pace as oil and gasoline prices fall. Here natural gas is represented by the largest natural gas ETF, the United States Natural Gas Fund (UNG), which also buys future price contracts of natural gas.

Natural Gas Prices Surge

Many economists believe the only solution to the soaring inflationary pressures we have been experiencing is a recession. Others believe market forces, such as actions taken and will be taken by the Federal Reserve, can mitigate a recession in the short term and prevent a full-blown economic crisis.

But one thing is clear, keep an eye on your natural gas bill going forward, no matter what oil and gasoline prices are doing.

Drew Voros can be reached at drewvoros@beanmedianews.com.