View Winners →

View Winners → LAEDC: Film/TV tax credit creates $22B in economic activity over 5 years

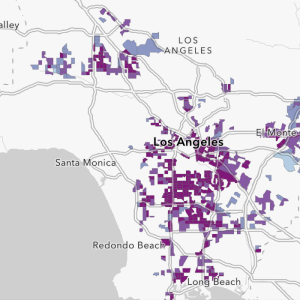

The Los Angeles Economic Development Corporation announced Friday that the California Film and Television Tax Credit 2.0 created nearly $21.9 billion in economic activity over five years and supported 110,000 jobs.

Overall, the program is estimated to have created $961.5 million in tax revenue for California, according to the analysis by LAEDC, which used data provided by the California Film Commission.

“We doubled the Film and Television Tax Credit Program last year because it’s brought productions to California, generated tens of billions of dollars in economic activity, and supported over 110,000 jobs,” said Gov. Gavin Newsom.

“No matter what you’re watching, whether it’s nominated for an Oscar or streaming on your TV, we’re making sure it’s filmed right here in California.”

The study analyzed data from the second generation of the tax credit program, which is called Program 2.0, which lasted from July 2015 to June 2020. A new Program 3.0 succeeded it in July 2020.

According to the analysis, the Program 2.0 allocated $330 million per year in tax credits as a way to grow production-related employment, stop production from leaving the state, and increase spending across California. For every dollar allocated by the tax credit, California benefited from at least $24.40 in economic output, $16.14 in gross domestic product, $8.60 in wages and $1.07 in state and local tax revenues.

“The success of this program is not only the jobs created and retained, but the economic engine it provides to other businesses throughout the region and the state,” said Dee Dee Myers, senior advisor to the governor and director of the Office of Business and Economic Development. “This LAEDC Report reveals how much that means to California’s economy — and why we’re so committed to this critical industry here in our state.”

Program 2.0 projects included the current Oscar-nominated films “Licorice Pizza,” “Being the Ricardos,” “Tragedy of Macbeth” and “King Richard.” Those four projects generated a total of $82.7 million.

The full study into the Film and Television Tax Credit Program 2.0 is available at laedc.org/2022/03/09/ca-film-tv-tax-credit-study.