By Jeff Prang / Los Angeles County Assessor

This month I want to take a moment of your time to visit about a property tax savings program my office offers that’s just waiting to reduce your budget. Moreover, I am going to be advocating for an increase in this tax-savings program.

I’m speaking about the Homeowners’ Exemption that has been available since 1974 that automatically reduces your tax burden by $7,000, if the home is your primary residence as of Jan. 1. That translates to an actual reduction of $70 to a homeowners’ tax bill. It’s not much and in dire need of an increase.

Let’s say hypothetically, the assessed value savings was to increase modestly to $20,000. That translates to an actual savings of $200. Since the whole point of the Homeowners’ Exemption is to encourage home ownership in the state, it should at the very least keep up with the rising costs of homes. In 1972 the median home price in California was about $34,500, where now home prices come in about $790,000 statewide, according to the latest figures from the California Assn. of Realtors.

For now, to get the existing savings, all the homeowner has to do is fill out the application at assessor.lacounty.gov/exemptions/homeowners-exemption and they are good to go. The deadline is Feb. 15 to get the entire savings but if you miss the deadline, please file anyway and you will get it prorated this year and the full amount the following years. Homeowners need only apply once in order to receive these savings each year. The savings continue until a change (such as a sale) is recorded.

However, nearly one in three homeowners in Los Angeles County do not take advantage of this tax savings’ program, leaving $30 million unclaimed each year. Across the County, an additional 435,000 families can be saving on their tax bills.

The Homeowners’ Exemption is even more important now than ever before because of Proposition 19. Prop. 19 changes the rules that apply to transfers between parents and children and grandparents to grandchildren. It mandates that any property not being used as the primary residence will not be eligible for the transfer of the existing lower tax rate.

Furthermore, the parent/owner of the home that is going to be left to the children should have the Homeowners’ Exemption at the time of the transfer. The child receiving the home does have one year from the date of transfer to acquire the Homeowners’ Exemption. If the home does not have the Homeowners’ Exemption, the children will not receive the tax benefit, and they could get stuck with a huge property tax increase.

I encourage the state legislature to study the matter and increase the Homeowners’ Exemption, even modestly. At the very least, it needs to have a clause that guarantees it keeps pace with inflation.

Our website will be continuously updated to provide general information on Proposition 19 that may assist taxpayers. For more information on Prop. 19 or other tax savings programs, visit assessor.lacounty.gov or call 213/974-3211.

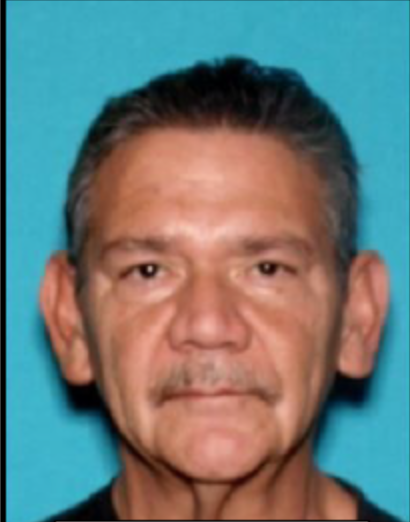

Los Angeles County Assessor Jeff Prang has been in office since 2014. Upon taking office, Prang implemented sweeping reforms to ensure that the strictest ethical guidelines rooted in fairness, accuracy and integrity would be adhered to in his office, which is the largest office of its kind in the nation with 1,300 employees and provides the foundation for a property tax system that generates $17 billion annually.