View Winners →

View Winners →

Launching and maintaining a business is a multi-faceted endeavor. Whether you are taking the steps to create a new enterprise or sustaining a long-term company, financial support is crucial. This is especially true in 2021, as many businesses are struggling to climb out of the economic detriment of COVID-19.

Small business loans are one of the most commonly acquired methods of funding. Even the most monetarily padded corporations benefit from institution issued capital as a means of financial support. This aids in budgeting, unexpected circumstances, and long term growth. Businesses with better access to capital logically have a higher chance of success.

Business Loan Process

As you seek out a business loan, there are several steps in this process. Applying for a loan can be levied through ample research and a sound understanding of your personal and professional financial circumstances. Initially, you want to have an awareness of how banks will assess you for a potential loan.

Major factors of qualification include your business credit history, personal credit score, collateral, time in business, and industry. These factors predict to lenders your capability and reliability when it comes to paying back their investment. Though no one wants to mix business and pleasure, your personal creditworthiness is an influential factor in a bank’s decision to issue a loan. Ideal credit scores should be in the 700s, with the length of your credit history also a consideration.

To increase your chances of receiving a loan, the SBA recommends that you compile a thorough business plan, expense sheet, and financial projections covering the next five years. This concise data is especially crucial if your business is quite young. Most lenders want to see at least a few years of records before funding a business venture.

Your industry also plays a part in financial support. Many lenders have particular preferences when it comes to niche trades. For example, a legal company is much more likely to acquire funding as opposed to a budding entertainment business.

Business Loan Programs

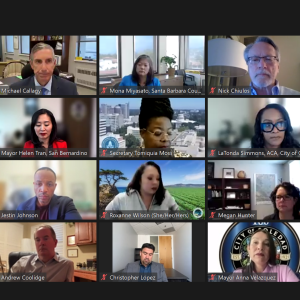

Business loan programs are pre established funding specifically designated to supporting small businesses and start-ups. Federally, the Small Business Administration (SBA) administers the MicroLoan Program which provides financial aid for individuals who struggle to find funding in the private sector. These groups include low-income earners, women, veterans, and minority entrepreneurs.

California’s IBank Small Business Finance Center offers a loan guarantee program designed to aid small businesses facing capital access barriers. Formerly coined as the Small Business Loan Guarantee Program (SBLGP) in 1968, this business assistance endeavor was created to combat unemployment rates and sustain small businesses. This lucrative statewide initiative strives to expand opportunities for self-employed individuals, small business owners, and entrepreneurs alike.

In the unprecedented aftermath of the pandemic, there are also increased business relief funds available for those in need of critical financial assistance.