View Winners →

View Winners →

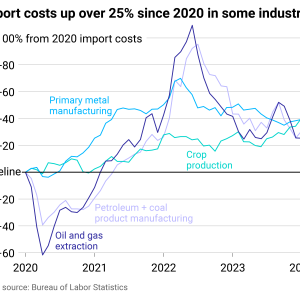

As the dust settles following the pandemic induced upheaval and uncertainty, the disparities in the U.S. housing market are clearer than ever. To be frank: the country is coming up short on 5.24 million homes. Though the economic turmoil of the past two years certainly contributed to the dismal state of the current market, it was not the sole transgressor. A statement from the White House press substantiates: “While the pandemic may have transformed preferences and caused supply chain disruptions, it did not create the underlying supply constraints in the housing market, which have decreased the stock of rental homes and homes for-sale.”

Evidently, home-building supply has not met demand for the past 40 years amidst steady population growth. This discrepancy has escalated in the last five years, with the pandemic only highlighting this reality. The market today is somehow neither in favor of buyers or sellers. Rather, home builders have the unique opportunity to fervently accommodate demand.

Purchasing Your First Home in 2021

Danielle Hale, Realtor.com’s chief economist, observes, “Millennials, many of whom are now in their 30s and even 40s, have debunked the industry’s ‘renter generation’ expectations.” Individuals within these age demographics and socioeconomic standings most likely rent not by choice, but by necessity. The idea of purchasing a first home is becoming less and less realistic for most middle-class Americans. This is due to several factors.

The gaps in the supply chain alone create limitations for potential homeowners; to further this estrangement, “entry-level” homes are no longer a priority in up-and-coming housing projects. These traditionally affordable houses were a critical element of young families’ ability to afford their first mortgage. Since the 1970s, attainable home building supply has sharply declined from 35 percent to 10 percent of the current market today. This means that even if home construction supply remedies the shortage, the resulting homes will be fiscally far too out of reach for families looking to buy.

Studies show that first-time home buyers today need at least a year longer to save for a 20% down payment. Additionally, renters likely need to save an additional $369 each month over the coming year just to match projected increase in home values.

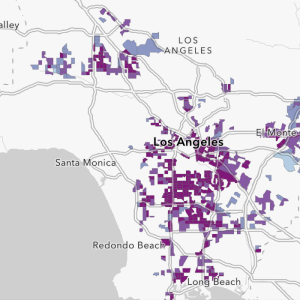

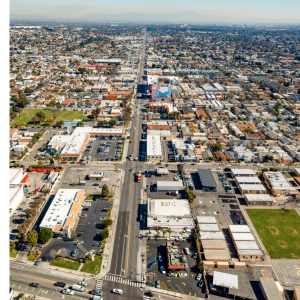

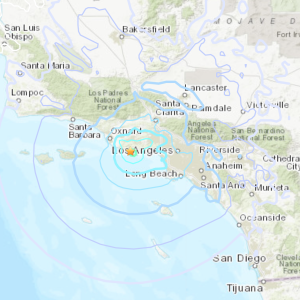

Lastly, the White House press highlights the shortage of available land in many urban and suburban markets. This is largely a result of public policy decisions made by municipalities regarding land access and usage. These disparities notably affect certain demographics on a greater scale, as the White House quotes, “For example, while the greater Los Angeles area, which is experiencing a housing crisis that disproportionately affects people of color, currently has 84 golf courses.”

What is to Come?

As 2022 quickly approaches, prospective home buyers are anxiously looking to the new year for mortgage predictions and possibly some much needed relief. Presently, the market remains askew due to the supply-demand imbalance. The only upside to the past five years of housing price increases is that mortgages are at an all time low. January 2021 saw mortgage rates decrease down to 2.65%. The reconstruction of mortgage plans has quelled some of the housing inflation, and motivated an increased number of buyers to acquire a mortgage of their own.

This shift from the Federal Reserve has made 15 and 30 year fixed rate mortgages more feasible for some, but it cannot help the rising cost of homes. Down payment costs are still a challenge for home buyers today, and many need the additional time to come up with the 20%. If a home previously appraised at $200,000 jumps to $258,000 in the current market, buyers would need to come up with an additional $11,600 for the down payment.

These stats are enough to make even the most financially padded individual think twice before signing those mortgage papers. In fact, a LendEDU article noted that 55% of Americans who purchased homes during the pandemic now regret that decision, while 26% have refinanced their mortgages.

Resources:

- https://www.whitehouse.gov/cea/blog/2021/09/01/alleviating-supply-constraints-in-the-housing-market/

- https://www.noradarealestate.com/blog/housing-market-predictions/

- https://www.businessinsider.com/how-2020-broke-the-housing-market-inventory-could-run-out-2020-9

- https://www.cnbc.com/2021/09/14/america-is-short-more-than-5-million-homes-study-says.html