View Winners →

View Winners → When All Else Fails Do a Rain Dance

As a note broker, I’ve had my share of notes that I simply couldn’t do anything with.

As a note broker, I’ve had my share of notes that I simply couldn’t do anything with.

Here’s one I was presented with recently: A delinquent seller carry back note secured by commercial property in West Palm Beach, Florida. The original deal looked like this:

Purchase price:$510,000

Down payment:$76,500

1st TD:$433,500

Interest rate: 7.5%

I/O monthly payment: $2,709.38

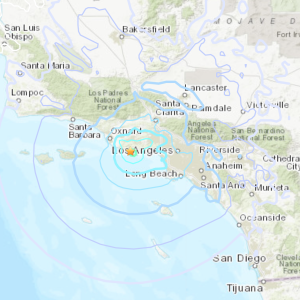

Due in: 60

The seller/note holder had received payments like clockwork for 2.5 years, and then, the tenant of the 3,000 sqft warehouse started defaulting on his lease. In the interim, the property buyer/owner had lost her job, so she had no way of making the payments on the note. The note holder no longer lives in Florida, she lives in Southern California.

This was a headache she just wanted out of . . . if she could get at least 50% of the loan balance. Most commercial property is heading toward a world of hurt. Even assuming that once the defaulting tenant was evicted, another tenant paying $3,000 a month could quickly be placed, the maximum value of the property at a 12 cap was something like $300,000.

So, I told the note holder that she would be very lucky to get 50% of the value of the property, or $150,000, and asked if she still wanted me to keep working on finding a buyer.

She said ‘yes.’ I sent the note profile out to several buyers, and got virtually no response. No one wanted a commercial note in Florida that was in default. So, I decided to give up . . . NOT.

I started thinking about other ways that the problem could be solved. If the seller would be willing to put the property on the market and sell,

I could negotiate a short sale on behalf of my client, the note holder, and she would walk away with more than she could possibly hope for on the secondary trust deed market. So, I posted a referral on Active Rain (a social networking site for real estate professionals).

I communicated with 3 or 4 agents in West Palm Beach, and told them about the situation. As it turned out, one of them happened to know the owner personally.

They went to their friend about putting the property on the market, with a guaranteed short sale approval that would leave some money on the table for her.

Nope . . . she wouldn’t do it. Somehow, without personal or rental income, she was going to find a way to keep the property. Hmmm. OK, let’s go with the flow . . . what if I could find a private lender that would give the owner a hard money loan? Then I would simply negotiate a short refinance (say around $150,000?), and still get my client what she wanted, leaving the owner in possession of her precious commercial property.

I don’t have the final word on this deal yet . . . I’m still waiting for the story to play out, but it’s fun to realize how many different ways there can be to create a solution.

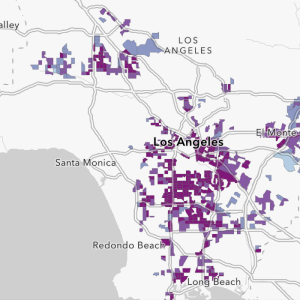

Note brokers and real estate brokers can often help each other out. If you’re interested in notes in the Southern California market, feel free to sign up at: http://notequeen.com/southern-california-note-buyers-and-private-lenders.

If you’re on this list, you’ll be notified of the local deals in property and paper that I come across.

Always consult with your CPA, tax attorney and/or financial advisor before selling property or paper.

Dawn Rickabaugh is a RE broker with expertise in seller financing and RE notes (trust deeds). www.NoteQueen.com 626.641.3931 dawn@notequeen.com.