View Winners →

View Winners → Owner will Carry

I just got back from Seattle. A client of mine decided to pay for a ‘platinum’ consultation, my plane ticket, and excellent wine.

I just got back from Seattle. A client of mine decided to pay for a ‘platinum’ consultation, my plane ticket, and excellent wine.

Why?

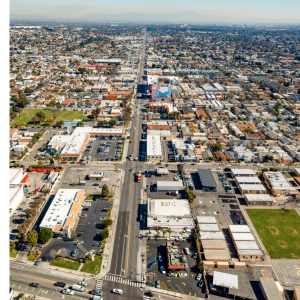

Because, despite the fact that the real estate market in is stronger than most, values have fallen for the upper end properties. It’s hard to move a property that’s listed above $1,000,000.

This is partly due to the limited financing available in the jumbo arena. Loans above $700K can be a lot harder for even highly qualified buyers to obtain.

So, this seller decided that he wanted to offer seller financing (advertise ‘Owner Will Carry – No Banks Needed’) to maximize the price he could get for his house.

He also wanted me to interface with local Realtors on his behalf. A year ago, he could have sold anywhere from $1,200,000 to $1,500,000. Today’s comparables suggest a list price of $900,000.

He really wants to get at least $1,000,000.

It’s very possible that he will be able to inch toward the million he wants by offering terms. We’ll have to see how the market responds. While I was there, I took 2.5 hours of raw video which I edited into three 10-minute segments.

One was an informal virtual tour to showcase the property in a very personal way.

It portrays the human story behind the impending real estate transaction, which creates emotional appeal and allows a deeper connection between the property and prospective buyers.

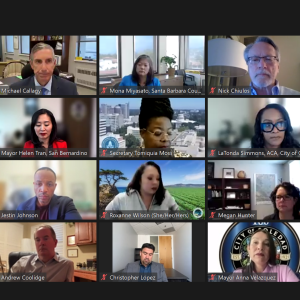

Another shows conversations with local Realtors, and the last focuses on conversations with the seller and why he was opting for seller financing. [You can view them all on my website].

His struggle represents one I hear from many sellers in his position. He was counting on the sale of this property to fund a major portion of his retirement, so the steep decline in market value really hit him below the belt.

He wants to unplug from the ‘Rat Race’ and live a very simple lifestyle in Spain for the foreseeable future. Without a substantial wad in the bank, it would be nerve wracking for him to do this.

For this reason, even though he had hired me to set up an owner financing transaction, I grilled him on whether or not seller financing was the way for him to go. If he only got a small down payment, say $100K, then that’s not much of a life cushion.

Even if he had to take $900K to attract a conventional sale (cash to new loan), he could still pocket at least $250K, which is a much better safety net.

A bird in the hand can be better than two in the bush. What if he carries the financing and there is a natural disaster? What if Microsoft moves out of the area?

Even with excellent underwriting, these types of events could really jeopardize the extra $100K equity he is trying to preserve by carrying (offering seller financing).

Even after I battered him with tough questions, he maintained that while he needed a decent amount of cash in the bank, he also needed to feel like he got a fair price out of the property, and he was willing to take the risk.

We determined that he would only take terms if he could get at least a 15% down payment. Depending on the deal, he may even be able to retain a portion of any appreciation that happens between now and the end of the seller financing term.

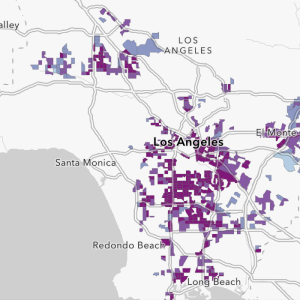

In our local area, there are many pockets of high end properties that just aren’t moving that well. Sometimes it’s worth exploring all the alternatives that are available.

Always consult with your CPA, tax attorney and/or financial advisor before selling any real estate.

Dawn Rickabaugh is a real estate broker with expertise in seller financing and real estate notes. www.NoteQueen.com; 626.641.3931; dawn@notequeen.com