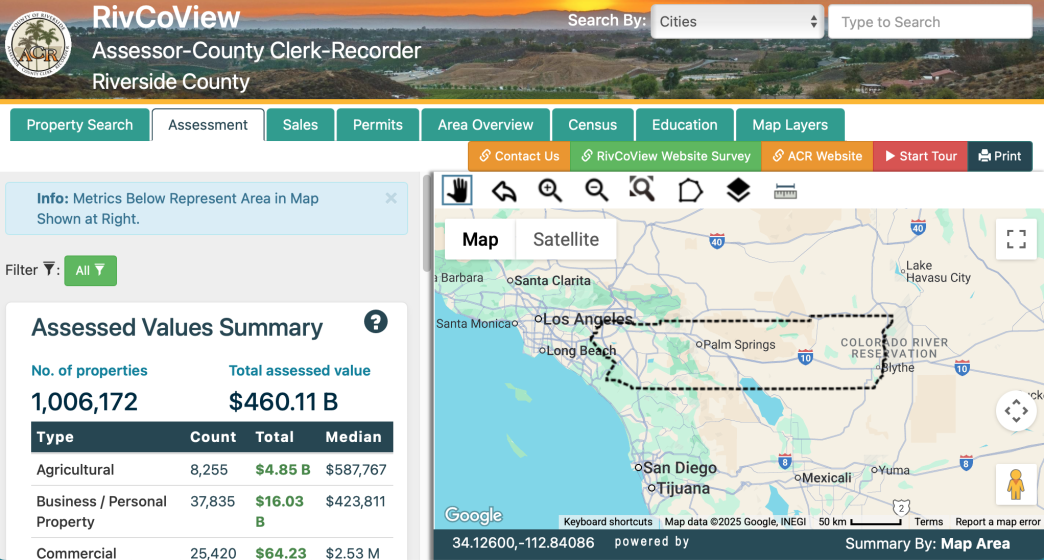

The Riverside County property tax Assessment Roll grew to $460.15 billion in 2025, the Assessor-Clerk-Recorder’s Office announced Monday.

The 6.28% increase over the previous year’s roll value of $432.97 billion includes all taxable real and business personal property in the county as of the state’s lien date of Jan. 1, officials said. The annual figure determines the property tax base for funding public services such as schools, public safety, health care and infrastructure in 28 cities and unincorporated areas.

The 2025 roll accounts for 970,645 secured parcels and 37,964 unsecured assessments, according to the county. Officials noted that the Assessor-Clerk-Recorder’s Office completed the roll on time “through a department-wide effort focused on fairness, accuracy, and compliance with state law.”

“Our team’s professionalism made this one of the smoothest closes in recent memory,” Assessor-Clerk-Recorder Peter Aldana said in a statement. “It reflects the dedication of our staff across the department.”

Riverside County’s assessment roll has grown by nearly $140 billion over the last five years, which officials said reflects “consistent development, property transfers and continued investment throughout the region.”

Assessed values for individual properties are now available for review online on the assessor’s website. Property owners who believe their assessed value exceeds the market value of their property as of Jan. 1 were encouraged to contact the assessor’s office or file an appeal during the official filing period from July 2 through Dec. 1.

Additional information is at rivcoacr.org.