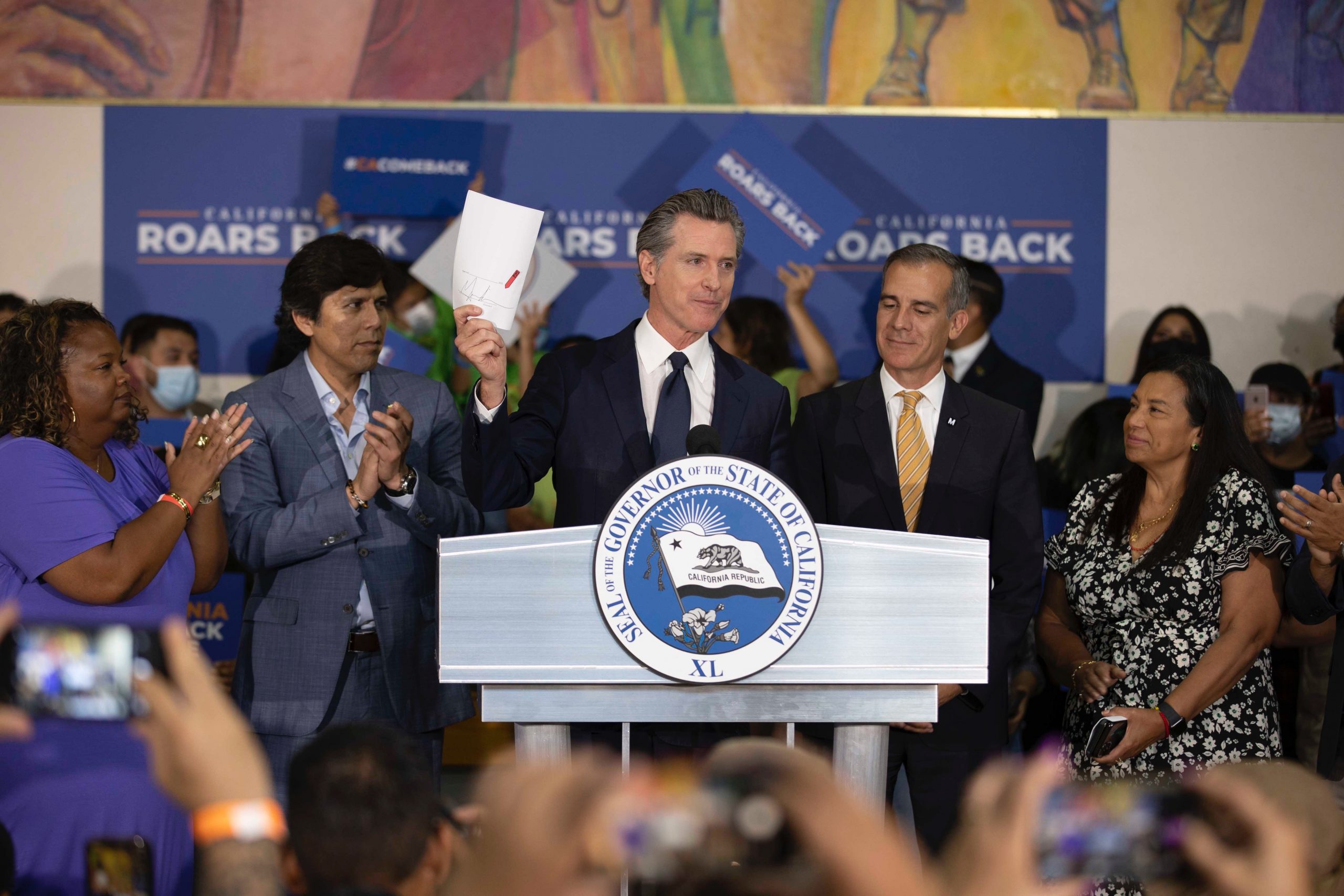

After announcing in May the potential of releasing more stimulus checks to two-thirds of Californians with his “Comeback Plan,” Governor Newsom signed his $100-billion project into existence — making it the largest economic recovery package in state history.

With this new plan, Newsom and his staff announced through a press release on Tuesday that the Plan will expand the previous Golden State Stimulus layout with the goal of helping assist middle-class families. In total, $12 billion will be released through stimulus checks, resulting in the biggest state tax rebate in American history.

Newsom held true to his promise, as nearly two-thirds of California residents are eligible to qualify for a stimulus check of $600, and qualified families with children are expected to receive an additional $500.

The plan is also placing a heavy emphasis on assisting small California businesses. $5.2 billion is being given to “help low-income renters and landlords, covering 100 percent of back-rent and all prospective rent for several months into the future.”

The press release also notes that on top of a $6.2 billion tax relief fund, Newsome’s plan is also investing a total of $4 billion in direct grants to small businesses.

“California is roaring back from this pandemic because we have your back,” said Governor Newsom. “It’s in that spirit that we’ve used California’s historic surplus to make historic investments. In partnership with the Legislature, we’re providing direct relief to struggling families and money into the pockets of small business owners across the state.”

Following his signing of the relief bill, Newsome attended a youth and family center in El Sereno and joined state and local leaders in lifting up the record-breaking Plan.

There, he emphasized that state residents — “regardless of race or zip code” — can qualify for the Golden State Stimulus as long as they file taxes before the date of Oct. 15.