Homes in the city of Los Angeles sold for slightly higher prices in February compared with the previous month, and were higher than housing prices a year ago, the California Association of Realtors reported Tuesday.

The $824,900 median price of an existing single-family home in the LA metropolitan area last month was 0.6% above January’s $820,000. LA city home prices were a 4.4% higher than the $790,000 median recorded one year ago, according to CAR data.

Los Angeles County’s median price in February was $852,190 for a single-family home, a 3.9% drop compared with January’s $886,400. In February 2024, however, a single-family home cost $817,100, or 4.3% less than this year.

In Orange County, home prices increased last month from $1.43 million to nearly $1.47 million. In February 2024, the same home cost $1.35 million.

Riverside County saw a 0.3% increase to $646,840 for a single-family home in February, up from $645,000 in January. The price a year ago was $624,900.

The median home price in San Bernardino County was $490,000 in February and $505,000 the month prior. The February 2024 median was $450,000. The monthly decrease totaled 3%, while the year-ago median price rose 8.9%.

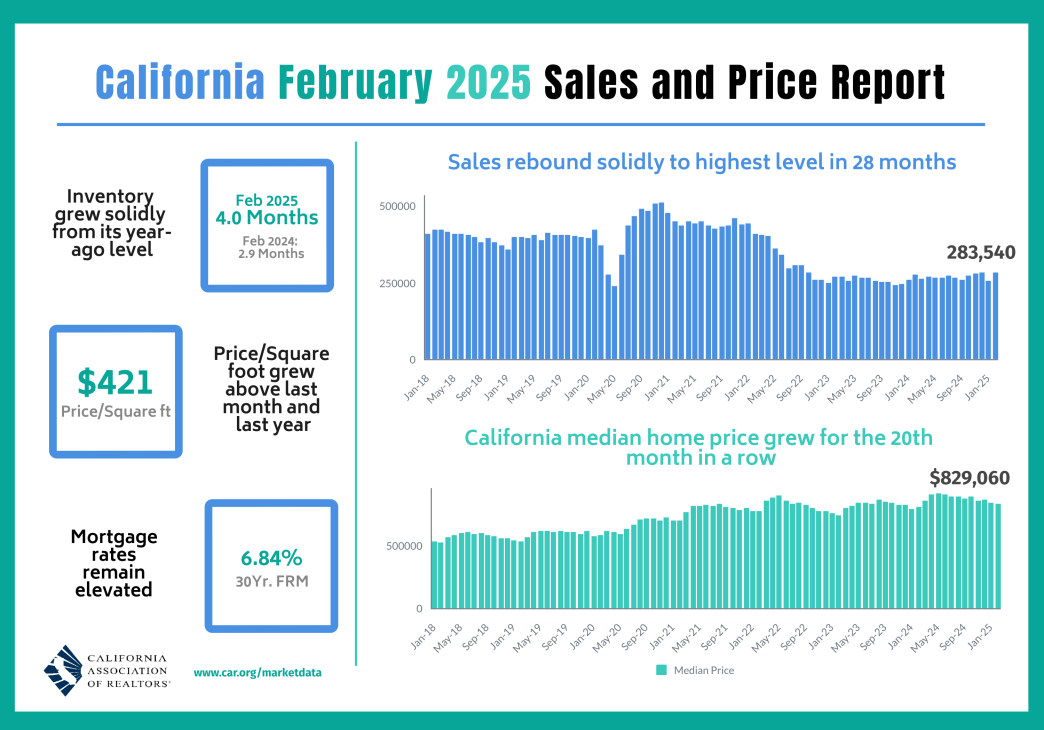

Statewide, the median home price was $829,060, a decrease of 1.2% compared with January but a 2.8% gain from $806,480 in February 2024. Year-to-date home sales in California rose 2.6%, totaling over 283,500.

Also statewide, pending sales in February dropped slightly from last year’s level for the third consecutive month, but the dip was much smaller than the decline in January.

“California home sales rebounded strongly in February after a sluggish start to the year, supported by increased buyer activity and more available homes on the market,” CAR President Heather Ozur said in a statement. “Lower borrowing costs made homeownership more accessible to buyers who were previously sidelined by affordability challenges, while the rise in available inventory will help ease some of the competitive pressures that have defined the market in recent years and set a positive tone for the market for the rest of the year.”

The statewide sales dip of homes in escrow could be due partially to a jump in mortgage rates in early February, “but the public’s growing concern of a recession may also have played a role in the slowdown in housing demand in recent weeks,” according to CAR. “The ongoing policy and economic uncertainties have been weighing on consumer confidence and have created instability in the financial market in the past few weeks. With mortgage rates expected to remain volatile in the near term, pending sales could continue to fluctuate as the market enters the spring homebuying season.”

The February statewide median price increased on a year-over-year basis for the 20th consecutive month, but the increase was the smallest since July 2023, according to CAR.

On a month-to-month basis, the state’s February median dipped from the previous month, which was larger than the 10-year historical average dip of 0.7% recorded between the two months. Despite the slight decrease, CAR analysts projected that the statewide median’s downward trend is likely to reverse in the coming months, as home prices usually start rising in March and continue increasing until the end of the home-buying season in August.

“The moderation in mortgage rates that began at the start of the year, coupled with a noticeable increase in homes for sale last month, provided a much-needed boost to California’s housing market in February,” CAR Senior Vice President and Chief Economist Jordan Levine said in a statement. “Although sales are still below historical averages, this increase marks an encouraging shift in the market. Despite ongoing economic and policy uncertainties, mortgage rates are expected to stabilize later this year. As a result, the housing market is likely to see continued improvement through the second and third quarters of 2025.”

The average length of time it took to sell a single-family home in California was 26 days in February, up from 22 days in February 2024, CAR reported.

The 30-year, fixed-mortgage interest rate averaged 6.84% in February, above the 6.78% a year ago, according to calculations by CAR based on federal weekly mortgage survey data.