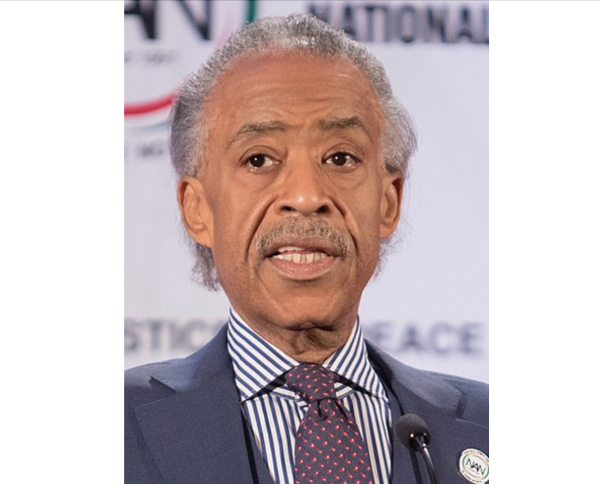

Los Angeles County Assessor Jeffrey Prang issued a bulletin a day ahead of Saturday’s due date for property tax payments that explained a deferral for fire-impacted stakeholders.

The bulletin released Friday provided answers to homeowners’ questions as they begin the process of recovering from the devastation wrought by the Eaton and Palisades fires.

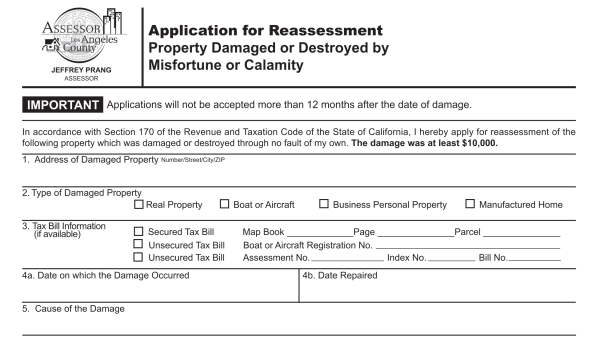

Residents who have suffered losses as a result of the fire may file a claim for disaster relief — the Misfortune and Calamity program, which provides a temporary reduction in property value that lowers property tax bills during recovery and rebuilding efforts.

While property tax payments are due Saturday with a possible penalty if payments are not received by April 10, Prang’s office pointed to Gov. Gavin Newsom’s executive order suspending penalties, costs and interest on late tax payments for properties impacted by the wildfires in these ZIP codes: 90019, 90041, 90049, 90066, 90265, 90272, 90290, 90402, 91001, 91040, 91104, 91106, 91107, 93535 and 93536.

The penalty freeze is in effect until April 10, 2026, for “secured and unsecured property taxes” due in 2025.

The Assessor’s Office and LA County Treasurer Tax Collector Elizabeth Buenrostro Ginsberg’s office recommend property owners who filed an M&C claim pay the outstanding installments under certain conditions:

“If you pay your property taxes directly to the TTC, filing an M&C claim automatically qualifies you for a deferral of those property tax payments,” and “if you pay your taxes through an impound account managed by your mortgage lender, property owners must contact their lender to explore available options,” according to Prang’s bulletin.

For landowners who paid the first or both installments of their tax bill, the assessor’s office suggested filing an M&C claim. Property owners could be eligible for a refund of the difference between the amount paid and the adjusted property tax total.

After receiving an M&C claim, the Assessor’s Office will recalculate the property taxes based on the reduced property value. The treasurer-tax collector will issue an adjusted tax bill, if applicable.

More information is available on the assessor’s website.

LA County has in-person disaster recovery centers at UCLA Research Park West, 10850 W. Pico Blvd., and in Altadena at 540 W. Woodbury Road.

Residents countywide also will have extra time this year to file federal and state income tax returns.

The filing deadline for county residents and businesses is now Oct. 15, the Internal Revenue Service and governor’s office have announced.

“The Oct. 15, 2025 deadline applies to individual income tax returns and payments normally due on April 15, 2025,” according to an IRS statement. “This relief also applies to the 2024 estimated tax payment normally due on Jan. 15, 2025, and estimated tax payments normally due on April 15, June 16, and Sept. 15, 2025. Penalties on payroll and excise tax deposits due on or after Jan. 7, 2025 and before Jan. 22, 2025 will be abated as long as the tax deposits are made by Jan. 22, 2025.”

The California Franchise Tax Board also extended the state tax filing deadline to Oct. 15.