State legislators advanced a bill that aims to make it more difficult for municipalities to sell the properties of homeowners who owe tax debts, officials announced Wednesday.

Senate Bill 964, which seeks to end the practice known as “equity theft,” received a 6-0 vote from members of the Revenue and Taxation Committee. The bill is scheduled for Senate Appropriations Committee consideration on Wednesday.

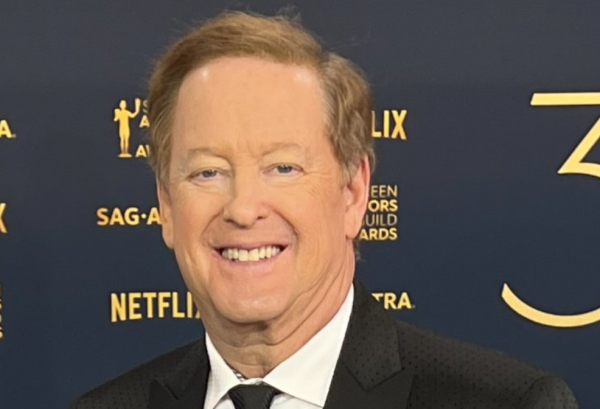

San Bernardino County’s auditor-controller/treasurer/tax collector, or ATC, and other municipal officials from the state testified prior to the vote.

ATC Ensen Mason said during his testimony that the “Chapter 8 process” is unconstitutional and violates and a recent Supreme Court ruling.

“Which law am I supposed to follow?” Mason told the committee. “I need some kind of legislative solution to this. We need to fix this so that we at least are doing things correctly from here on out.”

California is not in compliance with the U.S. Supreme Court’s ruling in a Hennepin County, Minnesota, case, officials said. The court unanimously found that a homeowner plausibly alleged a violation of the U.S. Constitution’s Fifth Amendment Takings Clause after the county sold her property to cover a $15,000 debt for delinquent property taxes “and kept the remaining $25,000 value of her equity as a windfall, leaving her with nothing,” according to the San Bernardino County announcement.

“The ruling shined a light on home equity theft in government, forcing the California Legislature to re-evaluate its process, which allows eligible taxing agencies and nonprofit organizations to circumvent the public auction process by purchasing tax-defaulted property for the nominal cost of back taxes, penalties, and fees without paying fair market value to compensate the owner for their equity,” San Bernardino County officials said.

SB 964 aims to eliminate that loophole by requiring tax-defaulted properties to either go through the public auction process to determine a home’s fair market value or have the State Board of Equalization assess the property’s value and determine the property interest is worth less than the amount of the defaulted taxes before a landowner’s property can be eligible for a Chapter 8 sale.

“In cases of auctioned-off property where the owner has defaulted on their taxes, the government should not be making a profit,” the bill’s sponsor Sen. Kelly Seyarto, R-Palm Springs, said in a statement. “The Supreme Court already outlined in their decision last year that profits belong to the owner. This is a simple ownership principle supported by the 5th Amendment.”

Video of the hearing is available at https://tinyurl.com/5726k4ap.