With demand diminished by rising interest rates and high home prices, the median price of an existing, single-family home in the Los Angeles metro area was $780,000 in July — down from $800,000 in June but still up from $731,000 one year ago, the California Association of Realtors reported Wednesday.

The month-to-month drop represents a 2.5% dip, but the year-to-year data show a 6.7% rise, according to CAR’s data.

Meanwhile, Los Angeles County trended in the same direction over the last month, with the median price dropping to $846,320 — down from $860,230 in June but up from the $809,750 in July of 2021. The month-to-month drop was 1.6%, while the year-to-year increase was 4.5%.

“Home sales have taken a trouncing as the market has shifted in response to the recent surge in interest rates, and pending sales suggest that the market could remain soft in August,” CAR Vice President and Chief Economist Jordan Levine said in a statement.

“The pace of sales declines is expected to slow in the coming months, however, as rates continue to stabilize, market volatility begins to subside and supply conditions further normalize.”

The median price in Orange County was $1.231 million in July, down from $1.265 million in June but up from$1.09 million in July 2021. Those numbers represent a 2.7% drop month to month but a 12.9% rise year to year.

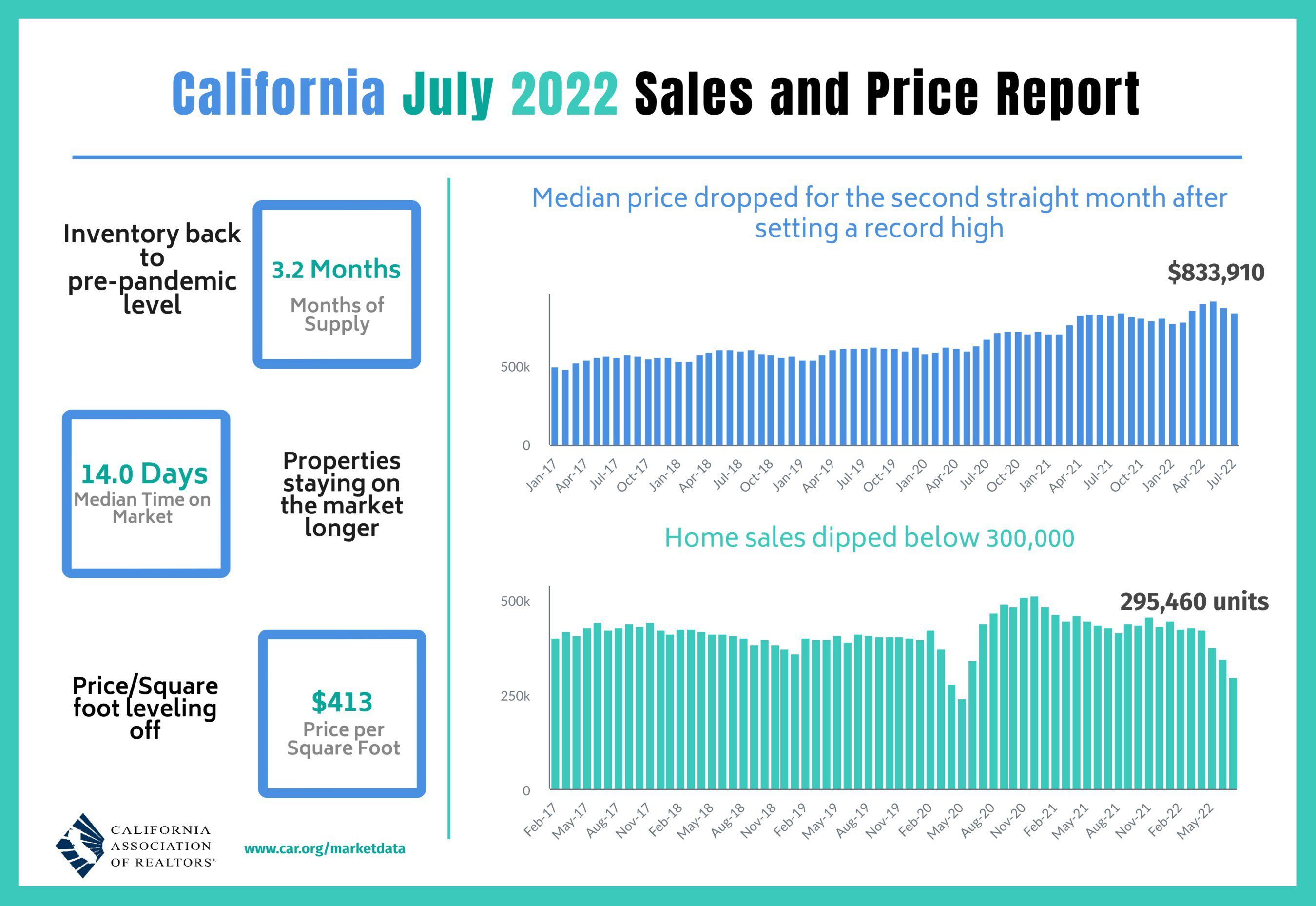

The median number of days it took to sell a single-family home in the Los Angeles metro area was 14 in July, up from 11 in June and from eight in July 2021.

In Los Angeles County, the median number of days an existing house was on the market was 13 in July, up from 10 in June and eight a year earlier.

In Orange County, the median time on the market was 13 days in July, up from nine in June and seven in July 2021.

San Diego County’s median price dropped from $950,000 in June to $930,000 in July. It was $860,000 in July 2021.

Riverside County’s median price in July was $625,000, down from $645,000 in June but up from $570,000 in July 2021.

Statewide, the median price of a home was $833,910 — down 3.5% from June but up 2.8% from July 2021.

Existing single-family home sales totaled 295,460 statewide in July on a seasonally adjusted annualized rate — down 14.4% from June and down 31.1% from July 2021.

According to CAR, statewide, home sales in July fell below the annualized 300,000 benchmark for the first time since May 2020.

July marked the fourth consecutive monthly decline and the 13th straight annual decline, the CAR said.

The annualized figures represent what would be the total number of homes sold in the state in 2022 if sales maintain July’s pace. Realtors adjust the figure to account for seasonal factors that can influence home sales, according to CAR.

Overall, year-to-date home sales statewide were down 13.6 percent in July.

The leaders in home prices continue to be in the San Francisco Bay area, where the median prices in July were $1.965 million in San Mateo County, $1.740 million in Santa Clara County, $1.72 million in Marin County and $1.7 million in San Francisco County.

“In the midst of the peak home-buying season, high home prices and rising interest rates depressed housing affordability to the lowest level in nearly 15 years, which in turn dampened home sales,” said CAR President Otto Catrina, a Bay Area real estate broker.

“However, buying opportunities remain in the coming months for those who have been waiting on the sideline as more listings become available, competition continues to cool off and rates begin to stabilize.”

Other key points highlighted in CAR’s July Consumer Housing Sentiment Index survey include:

- 76% of respondents believe the overall economic conditions in California will not improve in the next 12 months;

- 81% believe that interest rates will not fall within a year;

- 16% thought it was a good time to buy a home — a slight increase from 14% in June, and slightly down from last July’s 17%;

- 60% believe it is a good time to sell a home, pushing the Housing Sentiment Index to 59, significantly lower than the Index of 71 in July 2021.