View Winners →

View Winners →

While we have seen oil prices come down from their peaks of the year — with Los Angeles County seeing more than 30 days in a row of gasoline prices falling — natural gas prices, on the other hand, have continued their torrid pace up.

While falling gasoline prices may be providing some relief to drivers, the real energy burden hitting consumers quietly is natural gas prices. You may be using less natural gas or even the same amount unknowing that prices have doubled this year.

While most drivers can tell you approximately what a gallon of gas may cost, few know what the natural prices are today versus a year ago. We drive by gas price signs every day, but most do not check the natural gas on their SoCal gas bill.

On Monday the August Nymex contract was up 23.4 cents to $7.250/MMBtu, according to Natural Gas Intelligence. “MMBTU” is similar to a gallon of gasoline, but here it means “1 Million British Thermal Units.” That’s a big leap from its recent low of $2.53/MMBtu on March 21, 2021, and few have noticed.

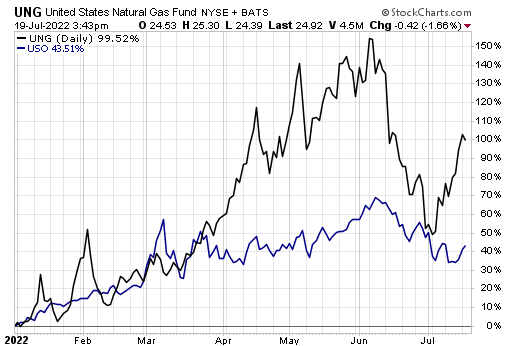

The chart below represents this year’s future prices of each, as represented by the two largest exchange-traded products for both: the United States Natural Gas Fund LP (UNG), which holds near-month futures contracts in natural gas and the United States Oil Fund LP (USO), holds predominantly short-term NYMEX futures contracts on WTI crude oil.

Why The Divergence?

Oil and gas are extracted at the same time on drilling sites in the US, which usually explains why they follow similar trajectories up or down. They don’t mirror each other but they correlate.

This summer we are seeing geopolitical and climate forces propelling natural gas prices continuously higher as oil prices downshift.

While Russia’s invasion of Ukraine triggered most of this year’s energy rally, much of that seems to be stabilizing, if not fading, as energy disruptions have not played out as feared. Thus, we are seeing falling prices at the pumps. But natural gas prices have been refueled by climate change this summer.

This week, there’s a historical heatwave engulfing the continent, with Portugal hitting a record 116 degrees Fahrenheit, the UK, Spain and France also lingering in the 100-degree mark. That heat increases natural gas demand to an already strained market that is under constant threat of cutoff by Russia’s leadership in retaliation for NATO’s assistance to Ukraine.

All this has repowered natural gas, where oil prices stabilize and fall as the summer driving season and peak gasoline demand slow.

Knowing Your Natural Gas Prices

Natural gas consumers probably have little idea how their SoCalGas bill is derived. According to SoCalGas, bills are calculated using three following factors:

- Commodity Costs – The cost of the natural gas itself

- Transportation Costs – The cost of natural gas delivery

- Public Purpose Surcharge – The cost to fund natural gas-related programs

Overall, about 92% of your bill goes toward products and services provided to you essentially at cost, with the remaining eight percent going toward a return on SoCalGas’ investment in the gas system.

This would be a good time to pay attention not to just your bill, but your usage, knowing what in your home relies on natural gas and being mindful that prices have doubled this year.

For more help about your bill or natural gas itself, visit SoCalGas.com.

Drew Voros can be reached at drewvoros@beaconmedianews.com