As the Federal Reserve tries to tame inflation by raising its benchmark interest rates at a historic rate, the domino effect can be clearly seen in the housing market, where any kind of interest move up pushes out thousands of prospective home buyers from qualifying for financing.

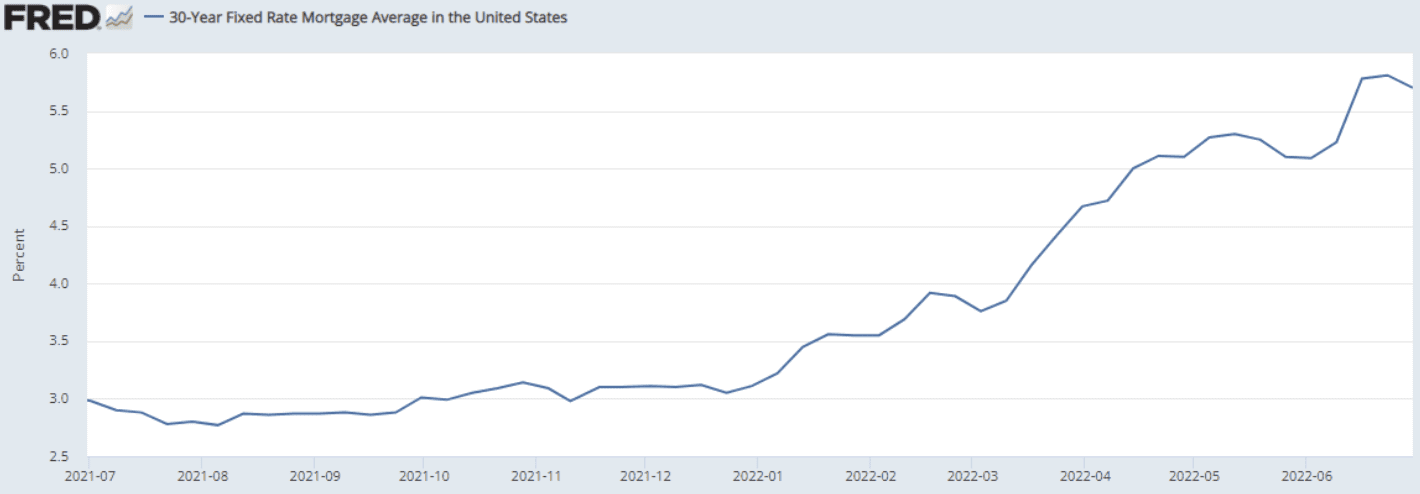

As mortgages become more expensive, demand for both homes and financing slows. And in the last year, the average 30-year mortgage has doubled, knocking out thousands and thousands of homebuyers trying to qualify.

30-year fixed-rate mortgage average:

Mortgage demand in the United States is now sitting at its lowest level in over two decades and roughly half the level from only one year prior. That’s a drag on the economy, from banks to Home Depot to U-Haul must bear the brunt of falling home sales.

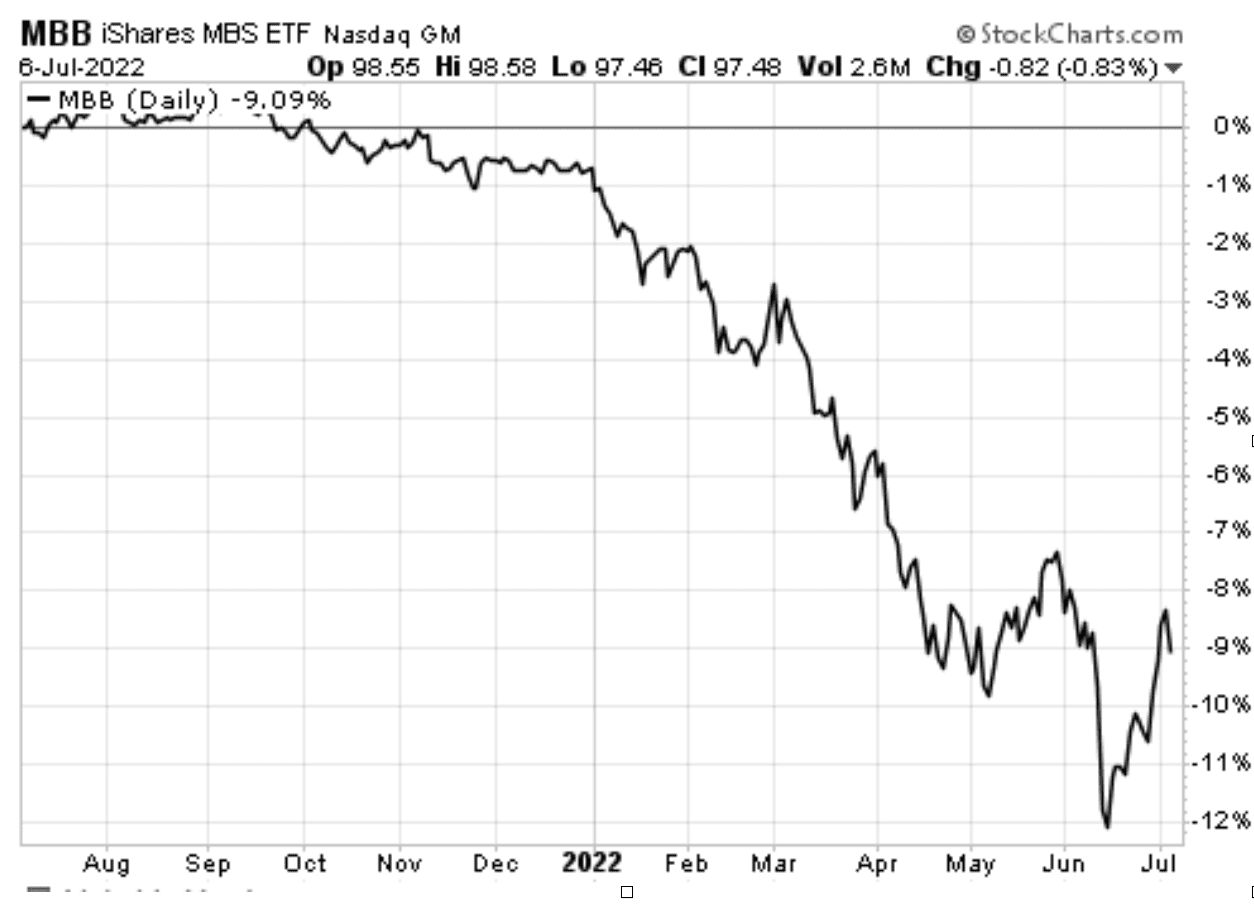

As represented by the mortgage-back securities ETF, the iShares MBS ETF (MBB) — which has more than $20 billion in assets under management — the torpedo effect of soaring interest rates, fueled by the Federal Reserve trying to extinguish runaway inflation, is evident. Mortgage demand has sunk.

Harder to qualify than a year ago:

In today’s mortgage industry, it takes typically 20% down and good credit to get a foot in the qualifying door. When mortgage rates rise, qualifying becomes more difficult depending on income.

In Southern California, there’s a double whammy impact. As financing doubles, home prices continue to rise as well. The average home price in the Southland is around $750,000. The math makes it clear.

The average rate of 2.5% for that $750,00 home carried financing of around $18,000 a year. Today, that same $750,000 home financed at today 5% is more than $37,000. That adds $1500 a month to the monthly payment

Buying a house is hardly as easy as it was 15 years ago when new homebuyer programs flourished despite high rates. That ease also had its pitfall as we saw during the Great Financial Crisis 15 years ago. The landscape for qualifying has drastically changed.

Shop around:

One of the biggest mistakes homebuyers make is not getting multiple mortgage rate offers. Many of those same people probably shop around for the cheapest gas price, but not for the biggest investment in their life.

“All too often, some homeowners take the path of least resistance when seeking a mortgage, in part because the process of buying a home can be stressful, complicated and time-consuming,” says Mark Hamrick, Bankrate senior economic analyst. “But when we’re talking about the potential of saving a lot of money, seeking the best deal on a mortgage has an excellent return on investment. Why leave that money on the table when all it takes is a bit more effort to shop around for the best rate, or lowest cost, on a mortgage?”

You can reach Drew Voros at drewvoros@heysocal.com