View Winners →

View Winners →

Millions of Californians are expected to get up to $1,050 in “inflation relief” by the fall of this year, thanks to a new budget deal reached by state lawmakers Sunday.

Referred to as the “middle-class tax rebate,” some 23 million Californians will receive the benefits as a response to inflation and rising gas prices.

Currently, the state has the highest gas prices in the country, averaging at $6.30/gallon for regular and $6.70/gallon for premium at time of publication, according to AAA. This is nearly 30% higher than gas prices in the rest of the United States.

“This budget takes immediate actions to give $$ back to millions who are grappling with global inflation and rising costs while tackling some of the greatest challenges of our time,” the Office of the Governor of California account tweeted on Sunday. “That’s more money in your pocket to help you fill your gas tank and put food on the table,” Governor Newsom said from his own account the same day.

Vehicle Rebate Rejected

Newsom proposed sending stimulus checks of $400 per vehicle—capping at two vehicles—to state residents earlier this year, but other lawmakers fought for a plan that would provide bigger checks to people with lower incomes.

The payments are structured like the stimulus checks sent by the federal government during quarantine, based on tax-filing status, household size and income. The checks act as tax refunds, coming from California’s record-setting $97 billion budget surplus.

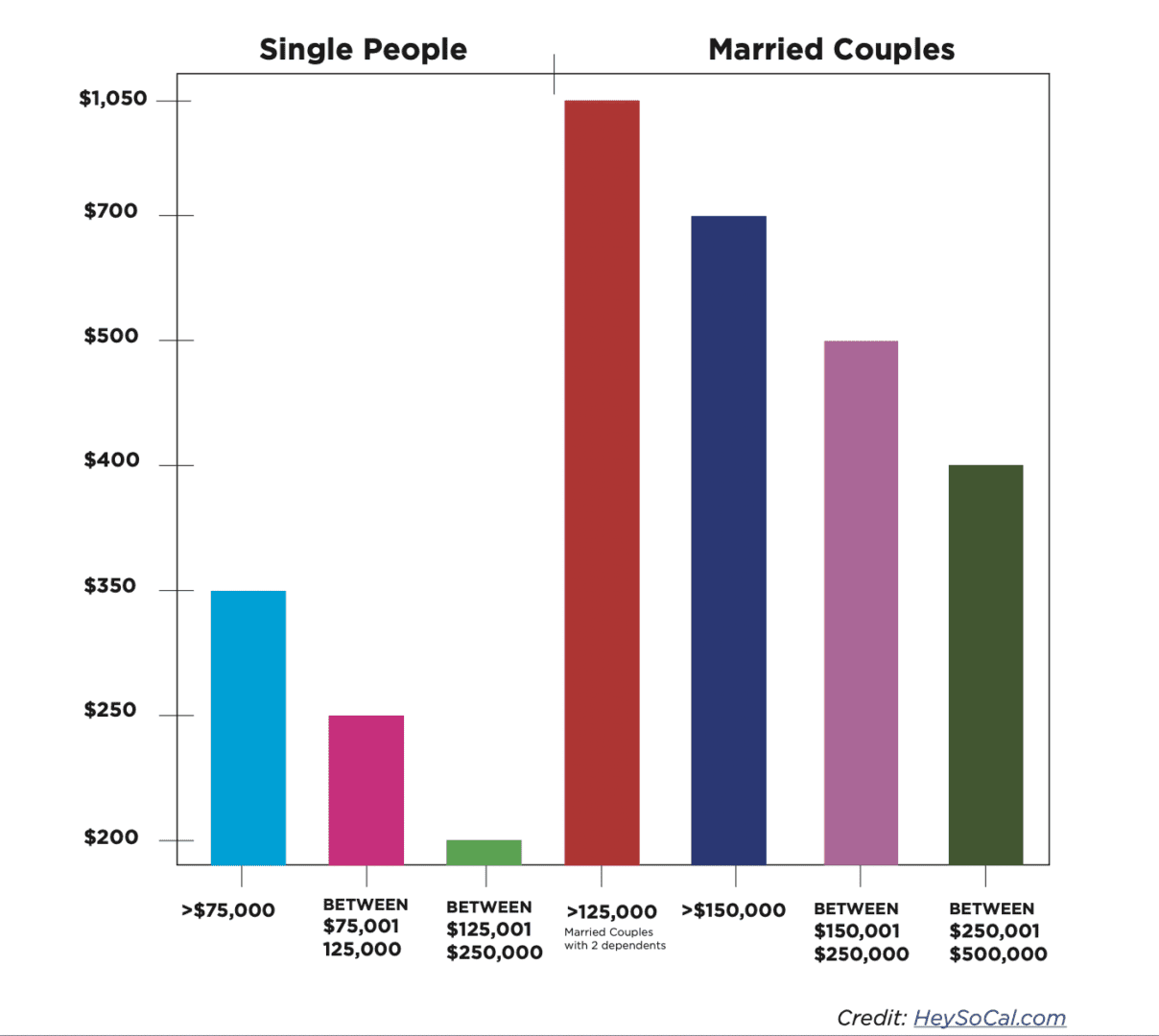

Low- to middle-income single tax filers in the state will receive higher payouts, while higher income and married couples who file jointly will receive lower payouts. Single tax filers are eligible for:

- $350 if they earn less than $75,000 per year

- $250 if they earn between $75,001 and $125,000 per year

- $200 if they earn between $125,001 and $250,000 per year

Married couples qualify for:

- $700 if they earn less than $150,000 per year

- $500 if they earn between $150,001 and $250,000 per year

- $400 if they earn between $250,001 and $500,000 per year

Who Isn’t Eligible

Couples earning more than $500,000 and single taxpayers who earn more than $250,000 aren’t eligible for the payments, as reported by the Sacramento Bee.

Households with dependents will receive an additional payment of their designated amount per adult. For instance, a couple earning a combined $125,000 annually and having two children would be eligible for $350 per adult plus $350 for their children, totaling $1,050.

KCRA reports that checks will be sent out via direct deposit or debit card by late October, though relief may come as late as next year.

It is yet to be determined how the relief checks will affect inflation in the state, or if California will send out additional payments.

Cervanté Pope can be reached at cpope@heymediagroup.com.