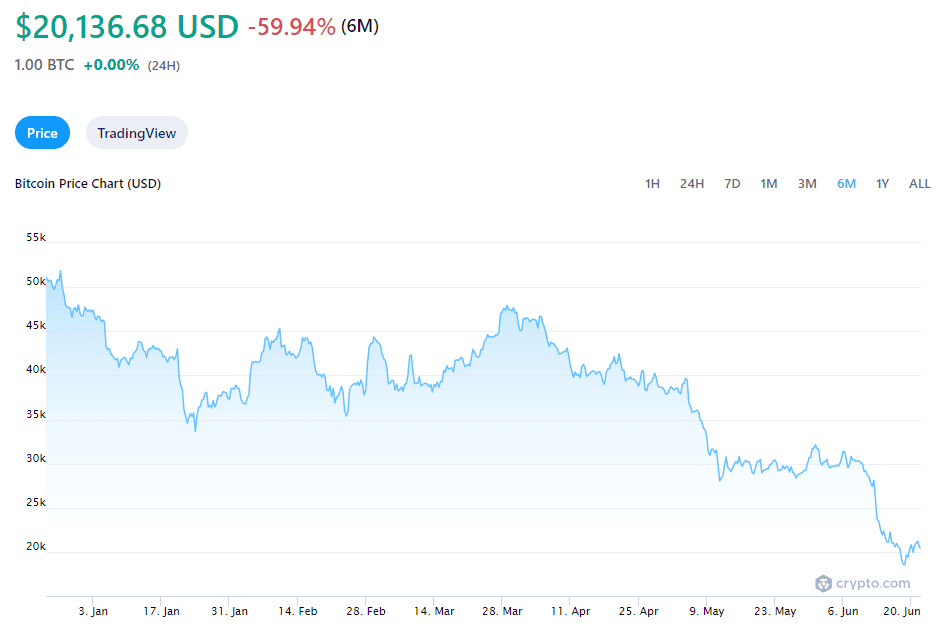

The sinking of Bitcoin prices continues Tuesday, with the cryptocurrency falling below $20,000 again, marking another correction in the space.

In January, Bitcoin dipped below $20,000 for the first time since 2020, but since has rallied only to be torpedoed again over the last few weeks.

At the beginning of the year, Bitcoin was trading for more than $47,000. The price movement has been volatile, as all financial markets have experienced this year. The trend is not Bitcoin-friendly.

Bitcoin Price Last 6 Months

“Bitcoin has made ‘a bottom’ but probably not ‘the bottom,'” Mark Newton, head of technical strategy at Fundstrat Global Advisors told Bloomberg News. “Upside targets should materialize near $23,300 with a max near $24,800 before prices pull back to likely challenge lows into the final week of June.”

Bitcoin, along with equities and more risky investments, has been in a freefall since the Russian invasion of Ukraine earlier this year and an ensuing surge in energy prices here and globally. That has increased inflation and the Federal Reserve has raised interest rates in response.

Decline seen continuing

“Macroeconomic conditions need to improve and the Fed’s aggressive approach to monetary policy has to subside before crypto markets see a bottom,” Informa Global Markets wrote in a note Tuesday, according to Bloomberg News.

“In a world where liquidity is plentiful, the bitcoins of this world do well,” Ian Harnett, co-founder and chief investment officer of Absolute Strategy Research, told CNBC’s “Squawk Box Europe” Tuesday. “When that liquidity is taken away — and that’s what the central banks are doing at the moment — then you see those markets come under extreme pressure.”

He went on to say that he would not be surprised to see the cryptocurrency dip to $13,000.

“It really is a liquidity play. What we’ve found is it’s neither a currency nor a commodity and certainly not a store of value,” he told CNBC.

Explaining his bearish call, Harnett told CNBC that past crypto rallies show Bitcoin tends to fall roughly 80% from all-time highs. In 2018, for instance, the cryptocurrency plummeted close to $3,000 after hitting a peak of nearly $20,000 in late 2017.

Drew Voros can be reached at drewvoros@heysocal.com.