View Winners →

View Winners → LA County home prices up 13% from 2021; OC prices up 27%

The median price of an existing, single-family home in the Los Angeles metro area was $770,000 in March, up from $725,000 in February and up from $680,000 one year ago — with the year-to-year hike representing a 13.2% increase, the California Association of Realtors reported Tuesday.

In Los Angeles County, the median price increased last month to $781,050, up from $773,490 in February and $689,440 a year ago — a year-to-year increase of 13.3%.

The median price in Orange County was $1.305 million in March, up from $1.260 million in February and from $1.025 million in March 2021. The year-to-year increase in the OC was 27.3%.

The median number of days it took to sell a single-family home in the Los Angeles metro area was nine in March, down from 10 in February but up from eight in March 2021.

In Los Angeles County, the median number of days an existing house was on the market was eight in March, down from 10 in February and even with the eight that was the median figure a year ago.

In Orange County, the median time on the market was six days in March, down from seven in February and even with six in March 2021.

San Diego County’s median price jumped from $888,000 in February to $950,000 in March. It was $800,000 in March 2021. Riverside County’s median price in March was $620,000, up from $605,030 in February and from $535,000 in March 2021.

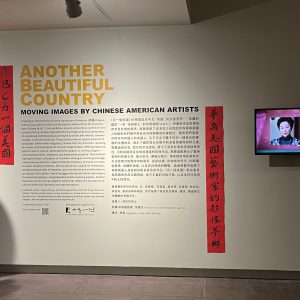

Statewide, the median price of a home hit another record high of more than $849,000 in March, driven by a surge in the sale of higher-priced homes, the Realtors Association’s data show.

The leaders in home prices continue to be in the San Francisco Bay area, where the median prices in March were $2.28 million in San Mateo County, $2.06 million in San Francisco County, $1.95 million in Santa Clara County and $1.737 million in Marin County.

According to the Realtors Association, with rising interest rates not yet having a significant impact on sales figures, demand remained strong statewide.

The closed escrow sale of existing single-family homes statewide totaled 426,970 in March — based on a seasonally adjusted annualized rate, the association’s monthly data show. That annualized figure represents what would be the total number of homes sold in the state in 2022 if sales maintain March’s pace. Realtors adjust the figure to account for seasonal factors that can influence home sales, the association said.

That sales number is up 5% from February but down 4.4% from March 2021, data show. The year-over-year drop for March was the ninth straight but the smallest in eight months, data show.

March’s statewide median home price of $849,080 was up 10.1% from February and up 11.9% from March 2021. But year-to-date statewide home sales were down 7% in March.

The new statewide median price topped the previous record of $827,940, set in August 2021. It also put the average price above the $800,000 mark for the first time in six months.

According to CAR calculations, the change in median price from February to March was the highest since March 2013, while the 10.1% jump from February was the first time in nine years that the month-to-month increase was in double digits.

Sales of million-dollar homes fueled the March statewide median price increase, according to the association, which reported they represented a record 32.9% share.

“March sales data continues to suggest strong buying interest and a solid housing market, as the effects of higher mortgage interest rates won’t be realized for a few more months,” said CAR Vice President and Chief Economist Jordan Levine.

“With the Federal Reserve expected to announce two back-to-back half-point interest rate hikes in May and June to combat inflation, interest rates will be elevated for the foreseeable future, adversely affecting housing demand and lowering housing affordability in the coming months, but the effects may not be visible until the second half of the year as many of the homes that are, or will be, closing were negotiated before the sharp increase in rates.”

The Realtors’ monthly numbers are gleaned by the association from more than 90 local Realtors and multiple-listing services statewide.