By Terry Miller

One of Arcadia’s largest financial scandals in 2015 involved crypto currency and a host of well-known public officials, including a former Arcadia mayor, for involvement in a Ponzi scheme that ultimately shut down the operations of the Arcadia business known as U.S. Fine Investment Arts, Inc. (USFIA).

The business was raided by federal authorities in 2015.

In February 2020, Gem Coin’s owner, Steve Chen, agreed to plead guilty to federal criminal charges that he falsely promised profits to more than 70,000 victim investors worldwide in a scheme where a multinational company issued a sham digital currency purportedly asset-backed by billions of dollars’ worth of amber and other precious gemstones.

Chen, 63, a.k.a. “Li Chen” and “Boss,” agreed to plead guilty to one count of conspiracy to commit wire fraud and one count of tax evasion.

In 2015 Gem Coin investors named former Arcadia Mayor John Wuo as being involved in the Ponzi scheme. The story was first broken by Arcadia Weekly reporter Joe Taglieri in 2015.

Chen was sentenced Monday to 120 months in federal prison for fraudulently obtaining $147 million from tens of thousands of investors around the world in the investment scam.

Chen, of Bradbury, was sentenced by U.S. District Judge John F. Walter, who found that Chen’s “litany of lies” promoted a scam of “epic proportions.” Chen pleaded guilty in June 2020 to one count of conspiracy to commit wire fraud and one count of tax evasion.

Chen was the owner and chief executive officer of USFIA Arcadia, and six other companies that used the same Arcadia address. From July 2013 until September 2015, Chen fraudulently promoted and solicited USFIA investments, and he ultimately obtained approximately $147 million from 72,000 victims, in one of the largest pyramid schemes ever prosecuted in this district.

He falsely promoted USFIA as a successful multi-level marketing company that extracted amber and other gemstones from non-existent mines it “owned” in the U.S., the Dominican Republic, Argentina and Mexico.

Chen “promoted his Pyramid/Ponzi scam using a multi-level marketing program in which compensation for recruiting other investors primarily came from new USFIA investors’ payments,” prosecutors wrote in their sentencing memorandum. “Because the primary focus was on recruiting other investors, rather than selling USFIA products to retail customers, the vast majority of investors were destined to lose money — while making [Chen] very wealthy.”

Investors were duped into buying USFIA investments in amounts ranging between $1,000 and $30,000 each. These “packages” purportedly comprised amber and other gemstones, as well USFIA “points,” which could be converted to USFIA shares when the company had its IPO. But Chen never intended for USFIA to go public.

USFIA offered other bonuses — including cash, travel, luxury cars, homes in the Los Angeles area, and EB-5 visas for immigrant investors — to investors who recruited other people to purchase these “packages.”

Beginning in September 2014, Chen and others altered the promotion by substituting quantities of “Gem Coins” instead of points. They falsely promoted these “coins” as a legitimate digital currency backed by the company’s gemstone holdings. Chen also falsely represented that these “coins” already were in wide circulation in the jewelry and finance industries.

The company did not generate any significant revenue from its business operations, apart from sales of investment packages to victim-investors. The amber and other gemstones provided in the investment packages — including those displayed at USFIA’s Arcadia headquarters — were obtained from domestic and foreign commercial suppliers, assigned grossly inflated prices, and worth much less than what investors paid USFIA for them. “Gem Coins” had no circulation in any industry, were not accepted by any merchants, and had no economic value.

Chen also committed tax evasion when he reported that his gross income for 2014 was $138,015, when in fact his income for that year was approximately $4,816,193, upon which Chen owed $1,885,094 — before interest and penalties.

Judge Walter ordered Chen to pay restitution of $1,885,094 to the IRS on the tax evasion count and scheduled a July 16 restitution hearing for USFIA victim investors.

Leonard Stacy Johnson, 54, of Huntington Beach, who worked at Chen’s direction in promoting USFIA and Gem Coins, pleaded guilty in July 2019 to one count of tax evasion and one count of making a false statement on an immigration document. Johnson is scheduled to be sentenced on May 24.

The Securities and Exchange Commission successfully brought an enforcement action against Chen, USFIA, and 12 other Chen-controlled entities. A receiver has been appointed by a court in that matter and maintains a website for victims at: usfiareceiver.com.

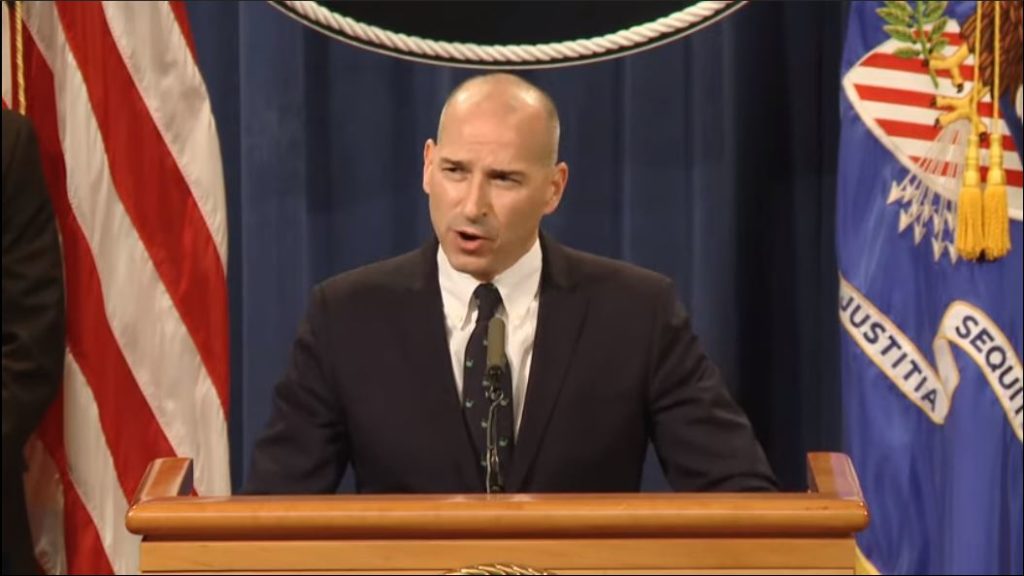

This matter was investigated by the FBI, IRS Criminal Investigation, and Homeland Security Investigations.

This case was prosecuted by Assistant United States Attorneys Richard E. Robinson of the Major Frauds Section and Katherine A. Rykken of the U.S. Attorney’s Office for the District of Oregon.