As the federal government fails to provide additional financial stimulus support to businesses, Governor Gavin Newsom announced during a press conference Monday that California will provide temporary tax relief and grants for eligible businesses impacted by COVID-19 restrictions.

The temporary tax relief entails an automatic three-month income tax extension for taxpayers filing less than $1 million in sales tax, extends the availability of existing interest and penalty-free payment agreements to companies with up to $5 million in taxable sales and provides expanded interest free payment options for larger businesses particularly affected by significant restrictions on operations based on COVID-19 transmissions. The total tax relief, if fully utilized, is estimated to have billions in impact.

Newsom also announced the creation of a new $500 million COVID Relief Grant program for small businesses. Funds would be awarded to selected intermediaries with established networks of Community Development Financial Institutions to distribute relief through grants of up to $25,000 to underserved micro and small businesses throughout the state by early 2021. Non-profits would also be eligible for these grants. CalOSBA is establishing the program and will make it available to small businesses as soon as possible — for updates on availability visit business.ca.gov.

The state is also expanding the California Rebuilding Fund by $12.5 million, bringing the total investment to $37.5 million. Last week, the Governor announced the opening of the California Rebuilding Fund which makes available $25 million to help impacted small businesses rebuild from the economic crisis and keep local economies strong. The additional funding will help the third party administrator of the fund raise $125 million to make more low-interest loans to small businesses with less access to loans from traditional banking institutions.

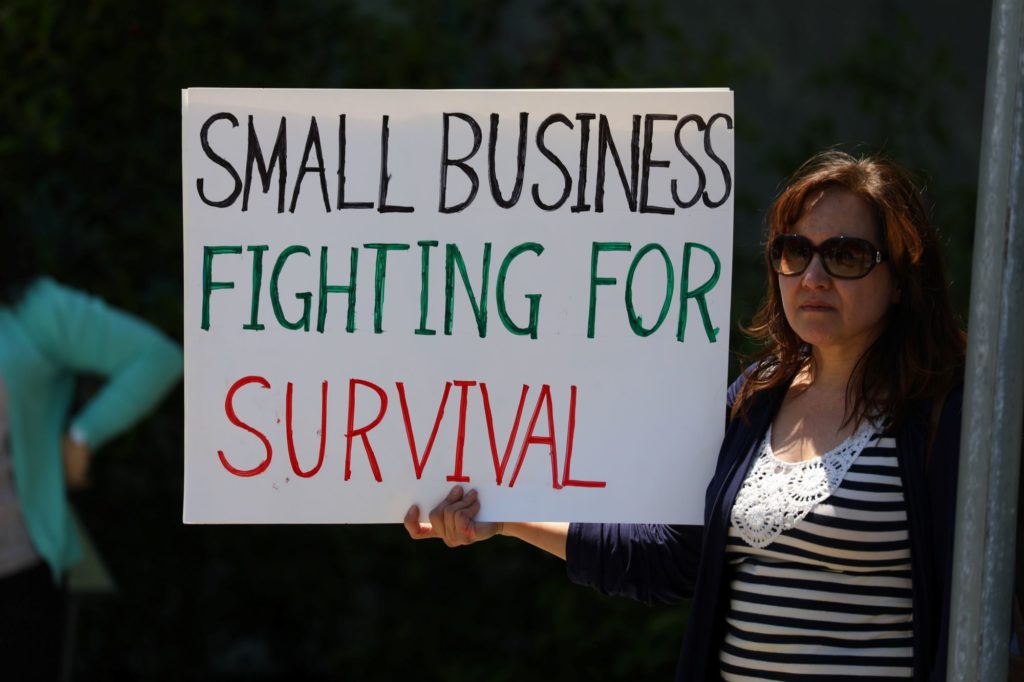

“California’s small businesses embody the best of the California Dream and we can’t let this pandemic take that away,” Newsom said in a statement released by his office. “We have to lead with health to reopen our economy safely and sustainably while doing all we can to keep our small businesses afloat. With this financial assistance and tax relief, California is stepping up where the federal government isn’t. By providing potentially billions in immediate relief and support, our small businesses can weather the next month as we continue partnering with the Legislature to secure additional funding and investments in small businesses in the new year.”

California is home to 4.1 million small businesses, representing 99.8% of all businesses in the state and employing 7.2 million workers in California, or 48.5% t of the state’s total workforce.

The COVID-19 pandemic has presented a significant challenge to small businesses, employers and employees. An August Small Business Majority survey data found that 44% of small businesses are at risk of shutting down. Data released through the Census Current Population Survey found that minority-owned businesses are disproportionately impacted: the number of active businesses owned by African Americans dropped by 41%, Latinx by 32%, Asians by 25%, and immigrants by 36%.