View Winners →

View Winners → Germany Uses New Green Bonds to Fund Past Environmental Spending

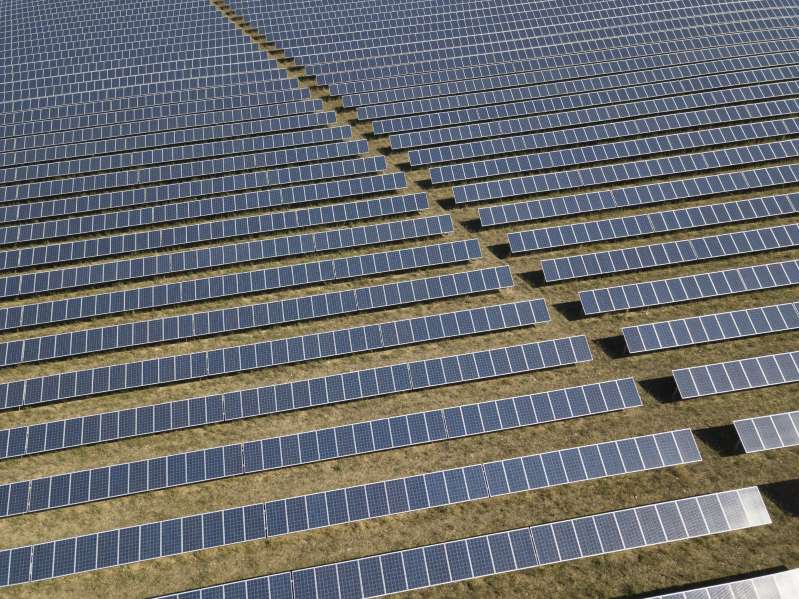

(Bloomberg) — Germany is raising new environmental debt to finance previous federal spending, prompting critics to say the label is misleading. The government is selling so-called green bunds today after a debut sale in September. It will use the proceeds to refinance 12.7 billion euros ($14.5 billion) of environmental spending from its 2019 budget.

While intended to fund what the country’s Finance Minister Joerg Kukies called an “ambitious climate program,” critics say the green bonds are relegated to rollover finance because of a legal quirk that requires lawmakers to approve draft budgets before the onset of the fiscal year. “Instead of labeling expenditure retrospectively, fresh money should be collected in the financial market for climate protection,” said Sven-Christian Kindler, lawmaker of the Green party in Germany’s lower house.

“Simply labeling bonds green without spending even one euro more on climate protection is greenwashing.” The practice of greenwashing, where the environmental benefit of an investment is exaggerated or misrepresented, is in focus as appetite grows for strategies that take environmental, social and governance factors into account. The European Union, where the majority of the world’s ESG assets are based, is stepping up its scrutiny of the industry — forcing asset […]