Governor Gavin Newsom announced Wednesday that Californians will see scheduled minimum wage increases next year.

Although current economic conditions authorize him to suspend the scheduled increase in the minimum wage for 2021, Newsom will move the increase forward as reflected in the 2020 state budget. The minimum wage will increase on January 1, to $13 per hour for businesses with 25 or fewer employees, and to $14 per hour for businesses with more than 25 employees.

“As we continue our efforts to slow the spread of COVID-19, we must also ensure that as our economy recovers, all Californians can benefit in its growth,” he said. “Not allowing this increase to go forward will only make life harder for those Californians who have already borne a disproportionate share of the economic hardship caused by this pandemic. Many of them are on the front lines of the pandemic, providing child care, working in our hospitals and nursing facilities and making sure there’s food on grocery store shelves.”

The governor also announced that over $1 billion has gone back into the pockets of more than 3.6 million working Californians and their families through the California Earned Income Tax Credit (CalEITC) and Young Child Tax Credit (YCTC).

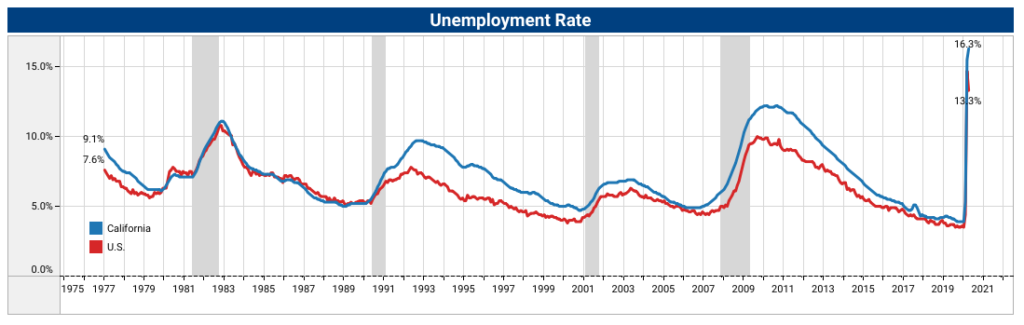

The COVID-19 recession has not only dealt a swift and broad-based blow to California’s economy — it has taken a disproportionate toll on low-income Californians, worsening income disparities that predate the pandemic.

As of Monday, more than 3.6 million filers claimed the CalEITC and YCTC, providing over $1 billion back to hardworking Californians.

“The CalEITC is providing critical relief for millions of low-income Californians and their families, many of whom were struggling before the COVID-19 pandemic and have been hit especially hard during this time,” said Governor Newsom. “The CalEITC and the new Young Child Tax Credit are helping families make ends meet.”

CalEITC-eligible families with children under the age of six can also receive up to $1,000 more by claiming the YCTC, established through the budget signed by the governor last year. Of the over $1 billion distributed through CalEITC and YCTC, $370 million was credited to 409,000 taxpayers who claimed the Young Child Tax Credit.

Last year, the governor expanded CalEITC, investing $1 billion to help Californians become more financially secure. He expanded the program so Californians making up to $30,000 per year now qualify and added a new Young Child Tax Credit for families with children under the age of six.