CORRECTION

Editor’s Note:

In today’s print edition of the Arcadia Weekly, a misleading and incorrect headline was attributed to a Galen Patterson story on the Citizens’ Financial Advisory Committee report from Tuesday’s council meeting.

The headline implies that council approved a sales tax increase. This is NOT correct.

Only the voters in the City of Arcadia can approve a sales tax and the city has merely accepted the submitted report. The sales tax measure may be on the June ballot. However, as City Manager Dominic Lazzaretto clearly points out… “All they’ve (Council) approved at this point is the idea to begin the steps to consider a sales tax.”

We apologize for the error.

By Galen Patterson

The first City Council meeting of 2019 was met with a report from the Citizens Financial Advisory Committee (CFAC). The CFAC’s report outlined the city’s expenditures, projected finances, and recommendations to improve Arcadia’s financially-difficult future.

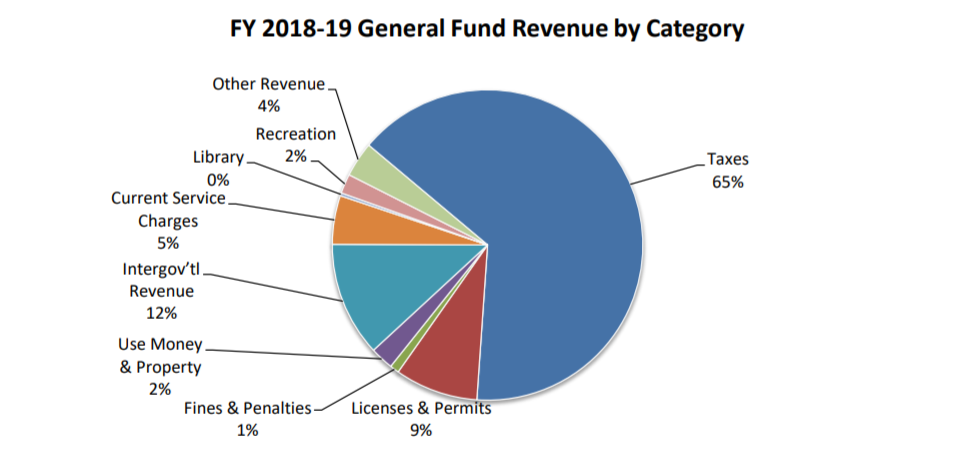

More than 60 percent of the city’s General Fund revenue comes from taxes, as shown by the committee’s final report, which pales in comparison to the next major source of revenue being Intergovernmental Revenue making up just 12 percent. Of that tax revenue, 37.3 percent comes from property taxes, while 29.5 percent comes from sales tax.

Arcadia’s sales tax rate is ¾ of a cent below what is allowed under California law. The report suggests taking advantage of that ¾ cent rate and raising it to the full amount, which is expected to help the city regain financial stability.

Raising the sales tax rate in the city would share the debt burden and spread it throughout everyone who comes to enjoy any of Arcadia’s unique shopping opportunities, like Rusnak Mercedes, the Westfield Santa Anita shopping center, and REI.

In an interview with then-city-council-candidate Bob Harbicht, Harbicht told Arcadia Weekly that the ¾ cent hike would help the city, and if the city does not use it, “eventually someone is going to come along and take it,” said Harbicht in 2018.

On Tuesday evening, Councilman Roger Chandler said “It’s the last remaining nugget we could actually grab, for use for our public,” and suggesting “I would run, not walk to grab this ¾ cent.”

The General Fund is where city services get their money. The largest pieces of the general-fund-pie are the Police Department taking 35 percent of the general fund, and the fire department taking 26 percent.

The report outlined just how much spending reduction is necessary to reduce the $8 million deficit if they made cuts across all the areas of expenditure. It would result in 56 city employees losing their jobs, including 23.5 full time police officers.

“The city of Arcadia is on an unsuitable path,” the conclusion of the final report states. The city has provided leadership and services to the community which the CFAC says is well-managed, but what Arcadia is doing for Arcadia is not enough. On Jan. 15, the city voted to implement the changes suggested by the CFAC. The council voted 4-0 in favor of the measures, excluding Councilwoman April Verlato, who was not at the meeting. The council applauded the decision and thanked the public.

The largest increase the city will see is the ¾ cent sales tax increase.

To view a full list of the suggested changes on the CFAC Final Report visit arcadia.gov.