By May S. Ruiz

In a few weeks high school seniors applying to UC and Cal State schools, or other universities through early action or early decision, will be sending out their applications. It is the last step in this grueling process that begins in 9th grade when they start to build their transcript.

These 18-year-olds spent four years of their life burnishing their resume with the hope that the admissions officers in the college of their dreams will admit them. A lot of them have a 4.0 GPA and perfect SAT scores, took a dozen AP courses, helped build houses in far-flung corners of the world, and acquired internships in the field they are passionate about.

What these students may not have thought of, though, is the price tag of a college degree. And the cost of tuition, books, accommodations, and meals is increasing every year. However, not every parent can afford to pay for their children’s college education, necessitating young people to get student loans.

A generation of young graduates is heading out into the world looking forward to a bright career but, at the same time, is carrying a huge burden on its shoulders. Student debt is now at a staggering $1.5 trillion.

So while students should follow their passion when they choose what to major in, it is as essential for them to balance their decisions with the realities of life beyond college and consider schools with the best earning potential.

To help parents and students make informed choices, PayScale, Inc., the world’s leading provider of on-demand compensation data and software, released its annual College Salary Report for the 2018-2019 school year. It is the only organization offering insightful, real time data based on crowdsourced figures and hundreds of compensable factors for both employers and employees to help them make important compensation decisions.

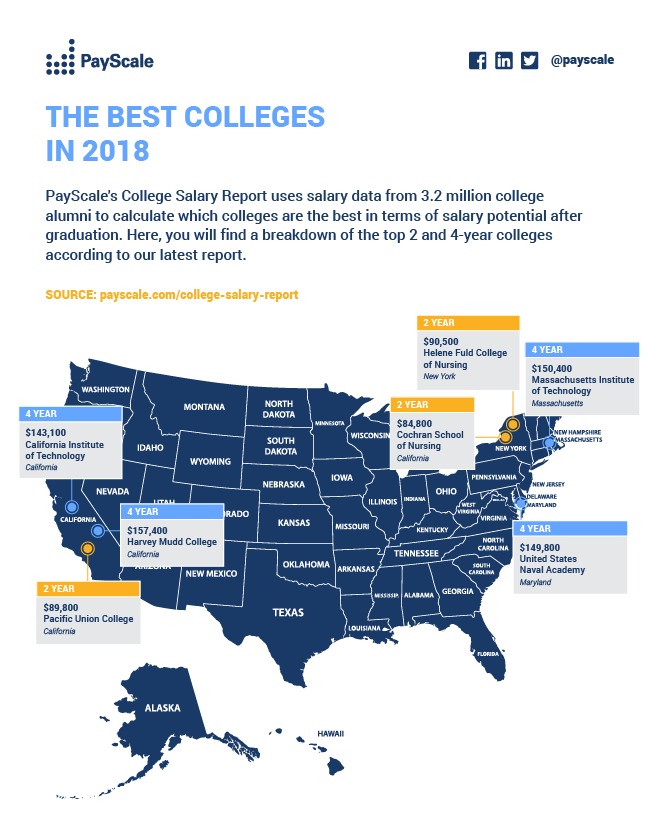

PayScale’s 2018-2019 College Salary Report uses data collected from more than 3.2 million college alumni, providing estimates of early and mid-career pay for 2,646 associate and bachelor’s degree-granting schools in the United States.

Lydia Frank, PayScale’s Vice-President details their organic growth, “The company was established in 2002 to help individuals understand how much they should be earning at their jobs. From there, we moved on to providing compensation information to employers.

“In 2008, we realized we had all this great data around what school people attended, what they majored in, and what they ultimately ended up earning – the kind of material parents and students need when they start their college search.”

“So we launched the College Salary Report ten years ago precisely to help parents and students make decisions as to what major to choose and what college to attend,” explains Frank. “We want to give them the information on how this will impact earning potential after graduation.

“There’s a lot of material out there telling students which college to attend based on reputation, teaching staff, and amenities available, but there aren’t any information out in the market about what they will be earning as a graduate from a particular school. We thought it was something unique we could bring to bear.”

“We didn’t expect it to take off the way that it did when we started it in 2008,” Frank discloses. “I think it became pretty obvious that we were unique in our ability to be able to provide this information so it became more mission-based – that we had to put it out there because it’s really valuable. It helps students figure out how much they should be borrowing and it gives them an idea what their income will be after graduating.”

Adds Frank, “The other piece of this is a report we put out in the spring of 2010, called College Return on Investment, which details how much it will cost to attend a particular school and the earning potential of its alumni.”

PayScale’s 2018-2019 College Salary Report shows the top 50 schools offering Bachelor’s degrees fall into 16 states, with California and New York home to 22 of them.

For associate degrees, nursing and healthcare provide the biggest payoff for graduates at half the cost of a four-year institution. Helene Fuld College of Nursing tops the list of schools in this category, followed by Pacific Union College, and Cochran School of Nursing. The majority of the highest-earning two-year programs are schools with strong reputations and a specific focus in nursing and healthcare professions.

Among four-year institutions, private schools fare better, with seven out of the top ten schools. Harvey Mudd retained the number one slot, with a mid-career pay of $157,400, $7K above the Massachusetts Institute of Technology (MIT), which placed second. Princeton, last year’s runner-up, fell to 9th place. The U.S. Naval Academy, the California Institute of Technology (Caltech), and Stanford round up the top five.

Ivy League universities, elite technical institutions, and military academies continue to top the list. Harvey Mudd College is a Liberal Arts school that grants degrees in only science, engineering, and mathematics. It is a member of the Claremont Colleges, and its fellow member schools – Claremont McKenna, Pomona, Pitzer, and Scripps – rank 43rd, 67th, 355th, and 374th, respectively. Colorado is the first interior state to appear on the list, with the Colorado School of Mines in 11th place and the U.S. Air Force Academy in 16th.

Looking at the best schools by major, Vanderbilt for Communications, Newman University for Education, and Union College in New York for Humanities have the highest earnings for graduates but they do not appear in the top 50 schools in the annual report.

Most of the highest-paying two-year majors are technology-focused, with software engineering in the top spot. Construction project management is the first non-tech-focused major in the list, ranking 4th. Engineering and math dominate the bachelor’s rankings, but petroleum engineering majors make far and away the most money mid-career. Operations research & industrial engineering, a newly included major, comes in second place, followed by actuarial mathematics.

STEM topped the list in terms of earning potential, as expected. However, students who want to pursue a Liberal Arts degree could take comfort in the fact that they will be able to catch up.

“Graduates with an Arts degree tend to not make a lot out of the gate but they end up making more mid-career,” reveals Frank. “We had some interesting findings when we looked at mid-career earnings at 10+ years. Degrees like Philosophy start to float up there. So it’s not that you shouldn’t major in Liberal Arts, you just have to know that it would take longer for you to be able to pay off debt. That you have to really be careful about how you fund your education.”

Indeed a Liberal Arts degree gives one a wide scope of knowledge which applies across fields. Some of the biggest names in business today majored in courses which their parents could have thought made them totally unemployable. Carly Fiorina, the former CEO of Hewlett-Packard, graduated from Stanford University with a B.A. in Medieval History and Philosophy.

Young people really can’t know how far they can go and what they can achieve based on their college degree. It’s up to them to make their own fortune.