City to explore alternative revenue measures; conduct community outreach

By Gus Herrera

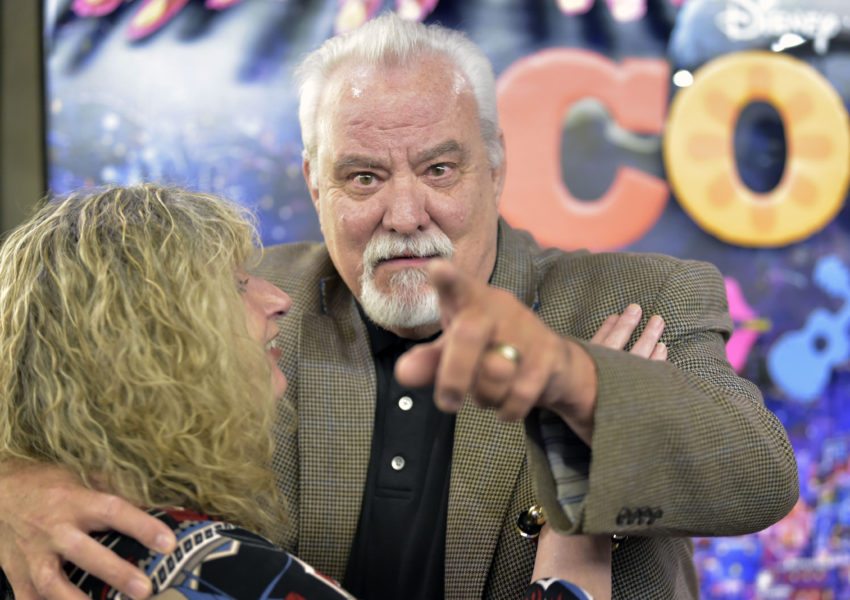

Per Mayor Terry Tornek’s suggestion, the Pasadena City Council recently deferred taking action on the endorsement of a proposed fiscal strategy that would call for continued fiscal responsibility and explore the possibility of a three-quarter-cent general sales tax.

The strategy, submitted to the council by the finance department and mentioned by Mayor Tornek during his State of the City Address, is an attempt to maintain city service levels and address capital needs in the face of “rising operating costs and stagnant revenue growth,” as described in city staff’s report.

While property tax has grown to become one of the city’s strongest revenue streams, other sources, such as the utility users tax and sales tax, “have been flat and declining,” according to City Manager Steve Mermell – “it’s a real shift,” he said.

Couple this trend with ever-increasing expenditures – both general fund expenditures and personnel costs have grown over the past 10 years – and the city now finds itself in a position where action must be taken if a drop-off in services is to be avoided.

“I think it’s the most important challenge,” warned Mermell, “we don’t have enough resources to maintain our current service levels, let alone all the other things we’re interested in doing.”

According to the city’s five-year forecast, the FY2019 operating budget faces a projected gap of $3.5 million, a gap which will more than likely call for additional position eliminations and noticeable service reductions, if nothing is done to create additional revenue.

Per staff’s report, city departments have already been directed to begin identifying potential reductions to bridge the gap. The city is also looking to engage a consultant to explore the potential re-structuring of emergency medical service delivery.

While Mermell did recognize the council’s “fiscal stewardship” and the city’s various efforts to balance the budget since the Great Recession – efforts which include $19 million in ongoing reductions, the elimination of 123 full-time-equivalent positions, an increased general fund reserve, and the shift of over $5 million in annual pension costs to employees – more needs to be done.

“The reality is we must balance our budget, relying on our savings is just not sustainable over time … our capital needs are only going to get more expensive,” said Mermell.

According to city staff, city receipts from the past two years indicate that a three-quarter-percent transaction tax “would potentially generate $22.4 million during the initial year of implementation.”

As it would be a general tax, the revenue would be used to support ongoing city services, capital investments, and infrastructure.

Mayor Terry Tornek also suggested holding an advisory vote to determine whether the populace would support dishing out one-third of the revenues received from the sales tax to the Pasadena Unified School District, which is similarly facing its own budget challenges.

Council Member Steve Madison challenged city staff to “consider alternatives more comprehensively” and to take into consideration variables which could affect the city’s projections down the line – variables that include federal tax reform, potential economic recessions/recoveries, and even the possibility that the PUSD could fall into state hands.

After a lengthy discussion, which lasted close to midnight, the mayor decided it would be best to allow more time for continued exposition and public outreach, “it deserves a little more cooking,” he said.

Council Members Victor Gordo and Andy Wilson made it clear that the process needs to be a comprehensive and transparent one, as imposing a sales tax would be a long-lasting decision.

“Sales tax doesn’t go away … we need to fill out that narrative so we can feel more comfortable that this is a good, long-term solution,” said Wilson.

“I do think we have a responsibility to let people hear us debate … and give people the opportunity to come and talk to us about the pros and cons of certain issues,” said Gordo.

City staff will return to council with more details in the near future, “I think we can bring this back quickly,” concluded Tornek.