View Winners →

View Winners → Just Take Over My Payments

“We just don’t want our property any more . . . it’s too much stress. We’re tired of being soaked by the bank, and we’re not going to send them another dime.”

“We just don’t want our property any more . . . it’s too much stress. We’re tired of being soaked by the bank, and we’re not going to send them another dime.”

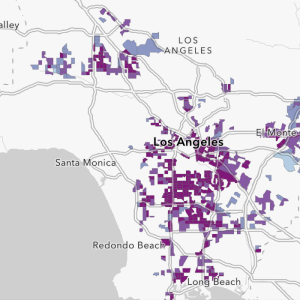

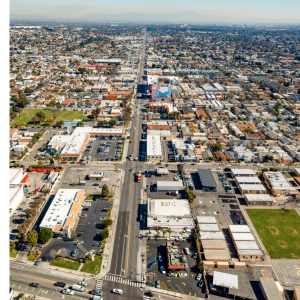

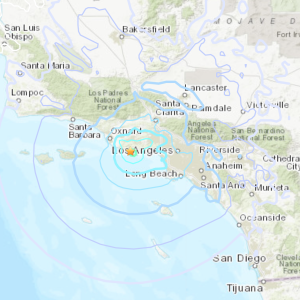

This frustrated woman and her husband bought a penthouse condo in Pasadena just above Cal Tech for $510,000 two to three years ago. It’s in a great location and has beautiful views of the San Gabriel mountains, but the mortgage payments are draining the life out of them.

In fact, they’re in the process of getting a divorce.

They bought because their broker promised them that it would be a good investment and definitely be worth over $600K in no time at all.

Whoops . . . that crystal ball thing can be kinda tricky. In today’s market, it’s probably worth somewhere between $425K – $450K, and they owe about $470,000.

The $408,000 first is a 5.7% fixed, and the $60,000 second is variable but capped at 9%. The payments on both mortgages plus the HOA come to about $ 3,700 a month (this does not include taxes and insurance).

They didn’t want the hassle of listing the property, but wanted to ask me what they should do. They’d like to preserve their credit if they can (they both have 775+ FICOs), but mostly they just want out.

I advised them that they might have a couple of exit strategies. There may be a buyer out there who can afford the payments, but can’t qualify for a loan for some reason.

This type of buyer may be willing to take over the payments on this slightly over-encumbered property in exchange for ownership (a beneficial interest in a land trust) without having to obtain their own bank financing.

I continued, “I have already sent out feelers to buyers I know that are looking for some sort of ‘lease-to-own’ scenario, so perhaps I will have a lead for you in the near future.

“However, as you are likely upside down, you may want to simultaneously get a short sale process started. I have an all cash buyer that is expert at negotiating with the banks.

“All she would need is your short sale package filled out, and she will take it from there.

“I don’t think you can lose attacking the disposition of your property from both angles. In either case, you will have the weight of it off of your shoulders in a relatively short period of time.

“Please feel free to call if you have any questions or concerns. For more information on how the land trust works, visit: http://notequeen.com/trust-transfer-system.

“Also, even if your credit ends up taking a hit, it won’t necessarily affect your ability to acquire property down the road should your objectives change.

“The last 2 properties I purchased were closed with seller financing. I make a point of closing most of my transactions without the need for new bank financing.” If any of you readers out there know of someone who would be interested in taking over the payments on this fully furnished Pasadena penthouse, be sure to contact me as soon as possible.

Always consult with your CPA, tax attorney and/or financial advisor before selling any real estate. Dawn Rickabaugh is a real estate broker with expertise in seller financing and real estate notes. www.NoteQueen.com; 626.641.3931; dawn@notequeen.com

“We just don’t want our property any more . . . it’s too much stress. We’re tired of being soaked by the bank, and we’re not going to send them another dime.” This frustrated woman and her husband bought a penthouse condo in Pasadena just above Cal Tech for $510,000 two to three years ago. It’s in a great location and has beautiful views of the San Gabriel mountains, but the mortgage payments are draining the life out of them. In fact, they’re in the process of getting a divorce. They bought because their broker promised them that it would be a good investment and definitely be worth over $600K in no time at all. Whoops . . . that crystal ball thing can be kinda tricky. In today’s market, it’s probably worth somewhere between $425K – $450K, and they owe about $470,000. The $408,000 first is a 5.7% fixed, and the $60,000 second is variable but capped at 9%. The payments on both mortgages plus the HOA come to about $ 3,700 a month (this does not include taxes and insurance). They didn’t want the hassle of listing the property, but wanted to ask me what they should do. They’d like to preserve their credit if they can (they both have 775+ FICOs), but mostly they just want out. I advised them that they might have a couple of exit strategies. There may be a buyer out there who can afford the payments, but can’t qualify for a loan for some reason. This type of buyer may be willing to take over the payments on this slightly over-encumbered property in exchange for ownership (a beneficial interest in a land trust) without having to obtain their own bank financing. I continued, “I have already sent out feelers to buyers I know that are looking for some sort of ‘lease-to-own’ scenario, so perhaps I will have a lead for you in the near future. “However, as you are likely upside down, you may want to simultaneously get a short sale process started. I have an all cash buyer that is expert at negotiating with the banks. “All she would need is your short sale package filled out, and she will take it from there. “I don’t think you can lose attacking the disposition of your property from both angles. In either case, you will have the weight of it off of your shoulders in a relatively short period of time.

“Please feel free to call if you have any questions or concerns. For more information on how the land trust works, visit: http://notequeen.com/trust-transfer-system. “Also, even if your credit ends up taking a hit, it won’t necessarily affect your ability to acquire property down the road should your objectives change. “The last 2 properties I purchased were closed with seller financing. I make a point of closing most of my transactions without the need for new bank financing.” If any of you readers out there know of someone who would be interested in taking over the payments on this fully furnished Pasadena penthouse, be sure to contact me as soon as possible.

Always consult with your CPA, tax attorney and/or financial advisor before selling any real estate. Dawn Rickabaugh is a real estate broker with expertise in seller financing and real estate notes. www.NoteQueen.com; 626.641.3931; dawn@notequeen.com